The US market’s concerns over the spread of COVID-19 may not yet be over, but the NASDAQ 100 e-mini enjoyed a solid week of recovery and is now sitting just below January 2020’s value. This is an impressive recovery by any comparison.

The market moves came despite the COVID-19 death toll and infection rates in the U.S. rising last week from 20,608 and 529,951, to 37,175 deaths and 710, 272 infections respectively.

The stimulus package is still unfolding, with qualifying individuals beginning to receive their $1,200 payment from the IRS, and Congress already making plans for a further stimulus package.

The US has not yet managed to show a reduction in infections. In fact, numbers continue to rise explicitly in areas not employing social distancing, and hospitals are still short of important medical supplies, even as testing methods are still not considered efficient enough.

At the same time, President Donald Trump released a plan to lift-restrictions state-by-state, with each state’s governor using their own discretion. Several of the state governors had pushed back against the president’s earlier claims that he had the authority to overrule their decisions on lockdown arrangements.

The market’s rise, which seemed to show little concern for the spread of the disease, may suggest the market is currently more focused on the impact of the stimulus package rather than the bigger picture.

Unemployment has reached an unprecedented 22 million people. Anecdotally, many Americans are keen to return to earning an income, and the coming week may see that occurring in some cases, under caution.

Major economic data to consider this week is:

- Crude Oil inventories – Wednesday

- Jobless Claims – Thursday (How is unemployment doing?)

- Durable Goods Orders – Friday (Is production expanding or contracting?)

Looking at the charts, there may be an entry opportunity into the NASDAQ e-mini if a healthy retracement occurs, while Gold (see last week’s commentary) now appears to be ripening. And for dessert, Sugar may be about to change trend with a possible entry to the upside.

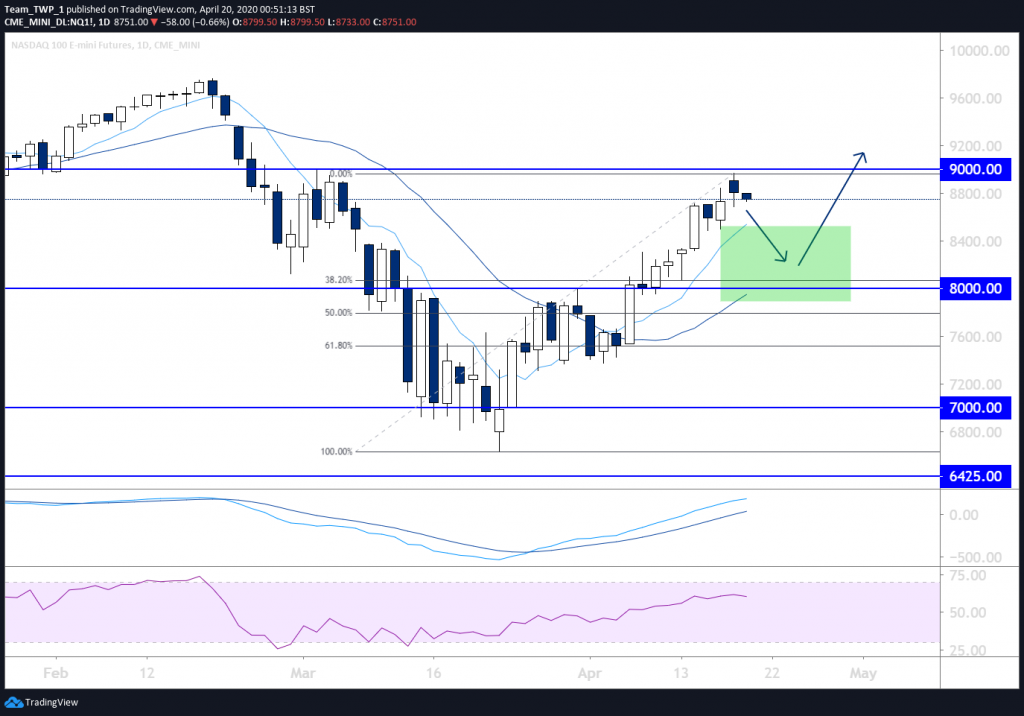

NASDAQ e-mini, Daily, Bullish

While the overall momentum of price is aggressively bullish, the trend on the daily timeframe displays the least volatility relatively speaking.

Price is technically due for a retracement back down to the 10 & 20 moving averages (MAs), which also sits just above the 38.2% and 50% Fibonacci retracement area.

A key historical level in this area sits at 8000, and may provide support for price if it retraces smoothly down to this level. Alternatively, there are also levels at 8300 and 8400 should price do a shallower pullback.

The area highlighted in green on the chart below may represent a good zone to stalk buying opportunities, small/medium sized bullish candlesticks here could be used as a trigger candle for a long trade.

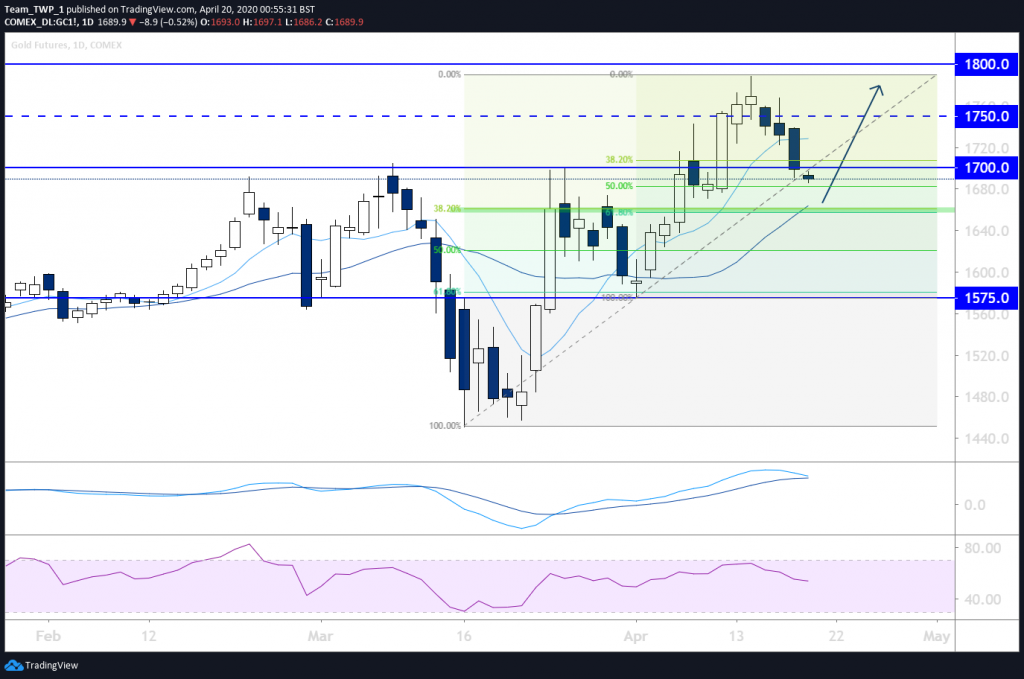

Recap/update: Gold, Daily, Bullish.

The monthly, weekly and daily charts show up trending higher-highs and higher-lows.

The MAs are in a bullish order and angle, supported by bullish momentum indicators.

Price has recently retraced down to 1700.00 and may test it for support, as well as find equilibrium in the area between the 10 & 20 MAs.

The area highlighted in green on the chart below may represent a good zone to stalk buying opportunities, small/medium sized bullish candlesticks here could be used as a trigger candle for a long trade.

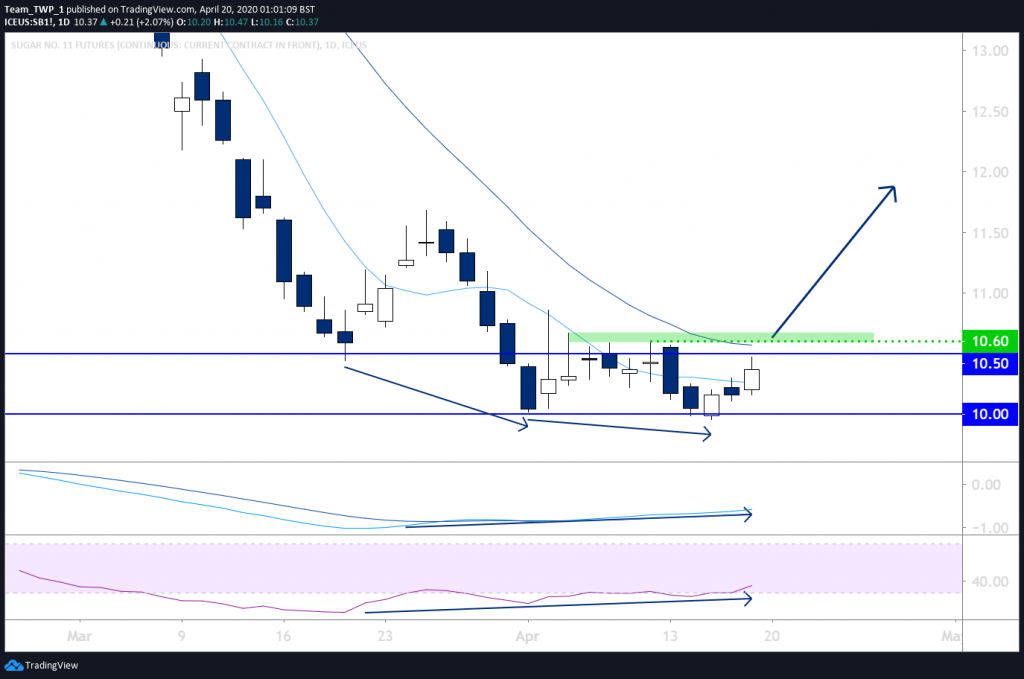

Sugar, Daily, Bullish.

The monthly, and weekly charts have generally been heading lower on Sugar, and so it is a consideration that the longer-term trend may maintain its bearish momentum.

There is clear technical divergence between price’s lows at 10.00 and both momentum indicators, which could imply a possible change in trend in the near future.

A confirmation of the change of this trend will arise if price breaks the high of the previous swing-high, at the dashed line around 10.60.

This area may be a potential entry into a fresh uptrend. Alternatively it may be more prudent to wait for price to retrace and test this level as support after it breaks up through the dashed level.

During periods of increased volatility, a reduction in standard account risk should be considered.

Taking profits if the moves are in the prevailing direction may mitigate risk further.

Risk management will be key, so a stop-loss is imperative, in order to protect capital exposure against unforeseen outcomes.