U.S. stock futures were trading lower this morning after corporate earnings were released after market Thursday and President Trump threatened China with more tariffs after the way they handled the coronavirus pandemic. The S&P 500 futures fell 2.1% after Apple released news that their earnings exceeded expectations, but their growth remained flat over last year’s basis. They also did not offer any estimate on June earnings with all the uncertainty created by the virus. This forced the stock to trade 2.6% lower in the premarket. Amazon also beat the estimates but warned that they will most likely lose money this quarter as spending is escalating to deal with the virus and the safety of its workers. It was this comment from CEO Jeff Bezos that helped fuel the 5.28% stock drop.” If you’re a shareholder in Amazon, you may want to take a seat, because we are not thinking small.”

Although the discussions are in the early stages, President trump suggested on Thursday that the trade deal with China is taking a backseat to the coronavirus and he is threatening new tariffs over the way Beijing handled the outbreak. These tariffs would have to be very strategic as he does not want to harm the current deal that is bringing personal protection equipment to the U.S.

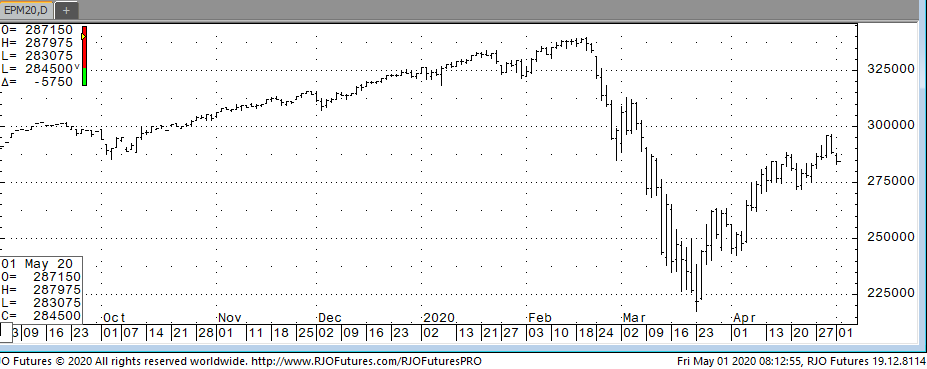

Support is checking in today at 285500 and 282500 while resistance is 293600 and above at 299000.