After a big down day yesterday, the S&P 500 has bounced back a bit this morning, led by a rally in tech, specifically Apple, which was down $8 yesterday. Another positive that developed overnight was a report that Treasury Secretary Mnuchin and China’s Vice Premier had spoken on trade. The conversation centered on China being interested in sending a trade official to the U.S. to discuss trade negotiations with our negotiators. We will have to see if that develops or was it a ploy to calm the markets, only time will tell.

One reason for the market drop yesterday was due to the price of crude oil, which fell over $3 and is already down 2.60 today. That fall put tremendous pressure on our stocks with many of the top oil stocks dropping as well. My belief is that the market is hoping for OPEC to intervene and cut production, but we have yet to see any signs of them doing so. Interestingly, yesterday afternoon, President Trump tweeted that he hopes OPEC stays away and he believes the price of crude should be much lower. The problem is that many of OPEC’s countries depend heavily on crude oil above 60$ a barrel, and many of their economies are hurting as the price is currently at 57$ a barrel. The worry here is that many investors are concerned about a spillover effect from these countries that could make their way to Europe and west to the U.S. We must watch to see any new developments occur near term.

Another big negative that we have seen in the last month or so is many of the commodities, especially our grain markets which have been very depressed due to the ongoing tariffs that we have with China. Our biggest exporter of soybeans is China, and due to the tariffs, have not been able to buy our beans and that has been a big blow for our economy. The longer these tariffs go on, the more damage both economies will face.

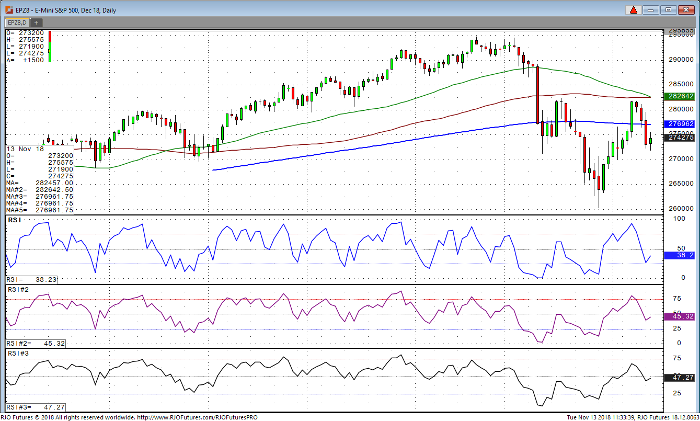

E-Mini S&P 500 Dec ’18 Daily Chart