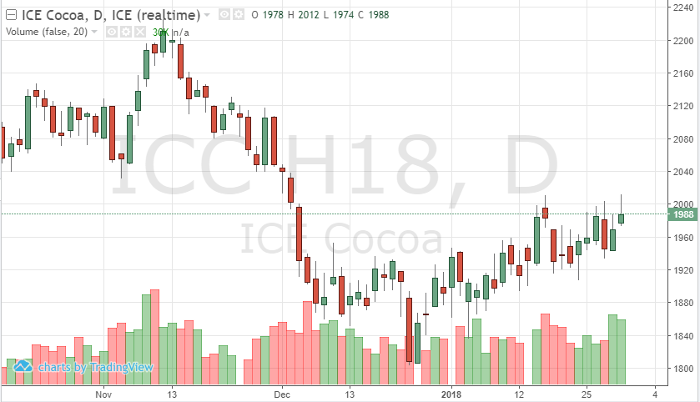

As we look at the March futures chart, the market appears to have found a range between 1880 and 2000. Although the contract has not been able to hold and move higher from 2000 of late – global currencies have provided support. Recently, the move lower in the dollar, a move higher in the euro and pound have given cocoa a positive underlying tone.

Supply concerns have surfaced after the ICC and CCC have said that disease and the removal of illegal farms could hurt supply levels and give market prices a boost. The Cocoa Farmers Association of Nigeria also reported disease seen on a large number of trees, adding pressure to supply numbers and providing support for further price growth.

Technically, a hold and close above 2005 is needed to have the March contract have a significant move higher. With first notice day in the futures for the March contract approaching mid-February, traders may have to look to the May contract to establish longer-term bullish strategies.

Cocoa Mar ’18 Daily Chart