In the early morning trade, gold has slightly fallen from yesterday’s highs as it tries to rebound from this week’s low and last week’s BIG sell off. So, I guess today in the day-to-day back and forth in U.S./China trade war news, is that now comments have shifted once again to the positive side of a Phase 1 U.S./China trade deal, which has caused another setback for the metals-we’ll see how long this news last. However, our chief economic advisor stated that the negotiations were down to “short strokes” and high-level negotiators on each side were in these meetings, which gives even more credibility to his statement. Furthermore, gold has completely broken down technically and now leaving the gold bears in clear demand of the market with even further bearish news overnight that gold ETFs holdings declined for the 7th straight session.

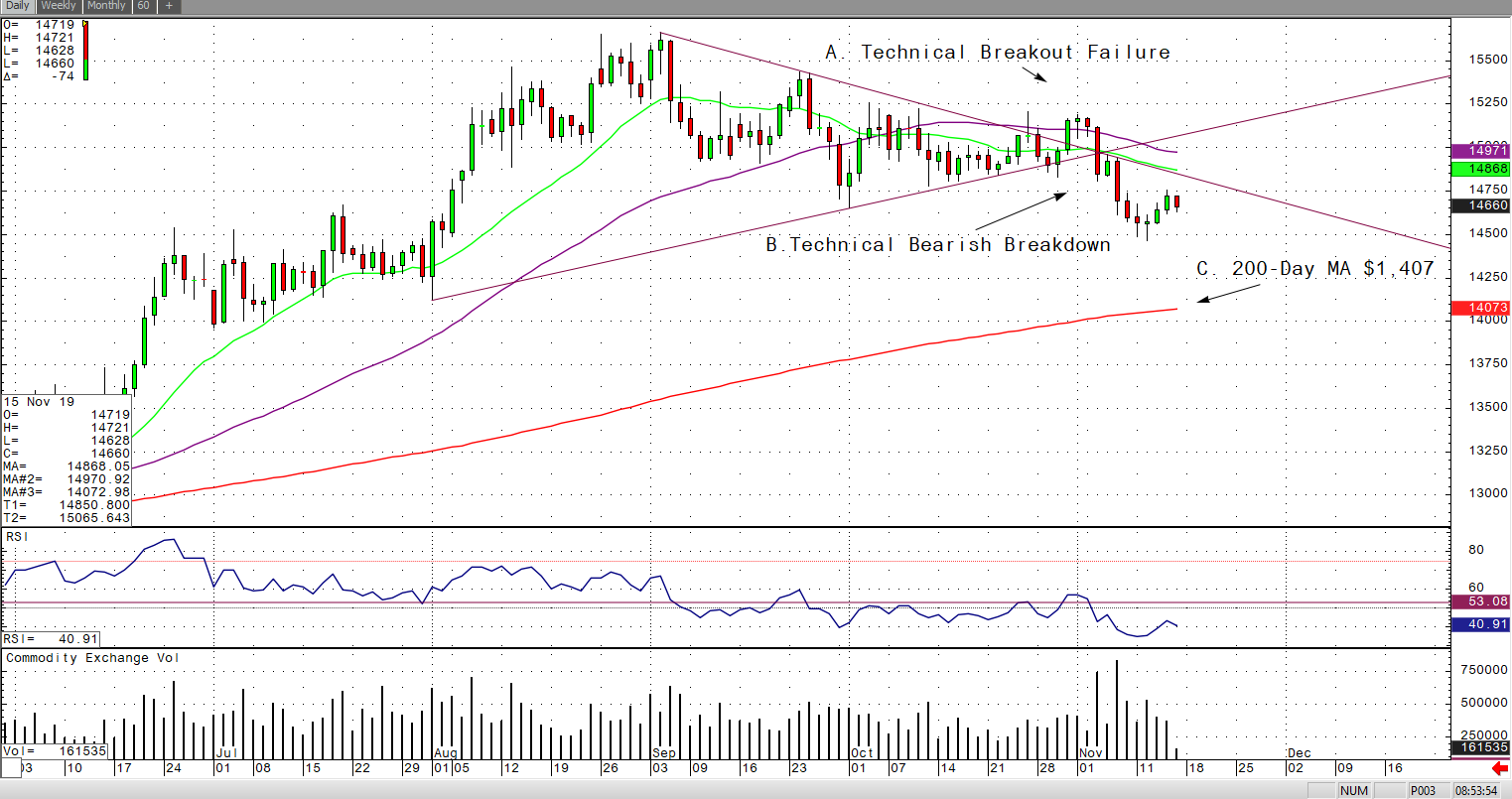

If we look at the daily December gold chart, you’ll clearly see how early last week it broke above technical resistance and could not hold onto its momentum after positive U.S./China trade talks, which prevented the shiny one to break a major technical long-time support level of roughly $1,475 an ounce. The bears have a clear advantage of this market now and I believe any kind of rally will be a selling opportunity for the bears. Furthermore, with last week’s sell-off the gold market is now opened to trading all the way down to its 200-day moving average of $1,407 an ounce. I highlighted these technical levels below on my RJO Futures Pro daily December gold chart.