In the early morning trade, gold has pulled back from this week’s high after finally breaking above $1,800 an ounce, but is currents trading at $1,767 an ounce. Yesterday, gold started to sell off from its high largely due to positive news that Pfizer and a biotech company out of Germany have made a promising drug for the Coronavirus, which Dr. Fauci stated could be available to the public later this year. Furthermore, gold continued its sell off this morning due to the very positive jobs number with unemployment falling to 11.1% in June with employers rehiring 4.8 million American, which is the highest record EVER recorded. Are we on the cusp of The Great American Comeback? If this trend continues-we sure are. Happy Fourth of July weekend to all!

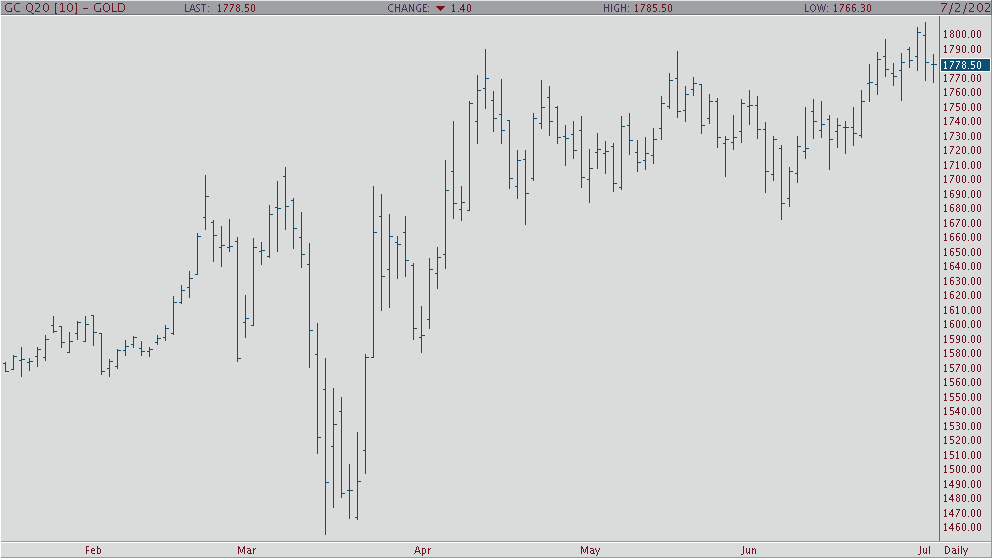

If you look at the daily August gold chart, you’ll clearly see that gold broke below a long term up trend and now is open to a possible sell off back down to the low $1,700s unless it rallies back today. If it can hold, look for gold to rally back to $1,800 an ounce.