Grain markets as a whole are still digesting last weeks USDA update. In that report we saw the corn market yields coming in at 178.4 BPA vs. estimates of 177.9 BPA. Also, we saw ending stocks adjusted up to 2.167 billion bushels vs. 2.120. Both numbers came in neutral/slightly bearish. Initially the market rallied, mainly from soybeans and wheat dragging it higher, in my opinion. This week I would keep an eye on the $4.00 level. Not only is this a psychological level, but there is good resistance dating back to the beginning of this year at these levels. If Corn continues to fail here, I expect we find somewhere around $3.80 to begin moving sideways again.

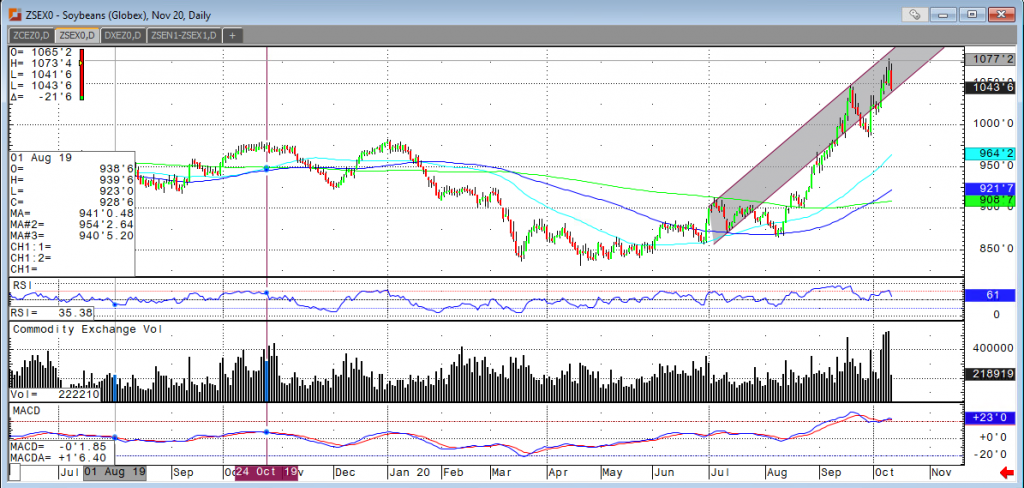

Soybeans, like the rest of the grain complex, rallied on Friday off the USDA update. Soybean yields came in at 51.9 BPA vs. 51.7 expected, so slightly bearish. The big new came with ending stocks coming in at 290 million bushels vs 363 million expected. This had soybeans up nearly 15-20 cents depending which month you are following. I expect this week to give us some long liquidation pull backs before eventually grinding higher again (assuming no other fundamental changes). If ending stocks are truly that tight, the rally will most likely resume once we have pulled back “enough”.

If you’d like to learn about the opportunities that exist in the grain markets right now, please request our exclusive Agricultural Investor Kit. If you have any further questions or needs, please contact Tony Cholly at 1-800-826-2270 or email him at tcholly@rjofutures.com

Our Grain Investor Kit Includes:

– In-Depth Fundamental Analysis and News on What is Currently Moving the Grain Markets

– Technical Analysis Overview with Possible Outcomes

– Analysis on Current Trends and Opportunities in the Market and How to Take Advantage of Them

– Historical Charts and Data Outlining Historic Prices and Trends