Last week, the price of gold futures rallied to the 1259-1260 level. This is the highest it has been since June 15. The stock indices had sold off enough that investors were again looking for gold as a safe haven.

Today’s action suggests that the flight to quality was temporary and short lived. Why? The markets are looking for more positive news out of the government data due out this week. This is also reflected in the positive bounce in the US dollar and the stock indices. This alone has seemed to turn the gold market. In addition, there are reports of a previously closed gold mine in South Africa that will be reopening along with the news that Chinese gold imports have fallen 40% in May. According to the Commitment of Traders report, the net long position by speculators has been reduced suggesting that longs took profits after last week’s rally. You may want to look at your options should the August Gold fall below 1241.90. The turning point back to the upside does not come in until new highs are made on a close above 1268.50 which was the intra-day high on June 15.

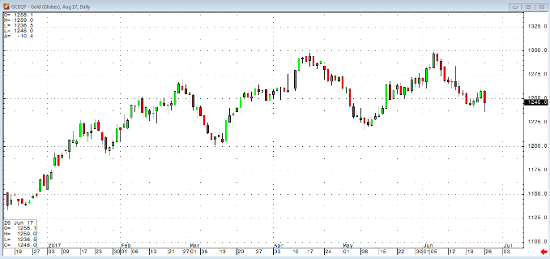

Aug ’17 Gold Daily Chart