The Shanghai Composite and South Korean KOSPI indices led the Asian stock markets which were mostly lower. The Chinese Yuan recorded a 7-month low Vs. the dollar and retail sales numbers in Japan were lower than anticipated. The North American session will start with a weekly reading for initial jobless claims that are expected to see a minimal weekly uptick from the prior 1.723 million reading. The last reading of the first quarter GDP is forecasted to hold steady with a previous 2.2 annualized rate.

There is hope that the administration is making progress on the China trade issue, but the market does not like the uncertainty and disagreements within Trump’s camp on the issue and this uncertainty is a crucial bearish influence in the short term for the S&P. In addition, emerging market concerns continue as higher energy and consumer good prices due to increased global tariffs are factors which are helping send investors to the sidelines. Resistance is around 2729 and 2762 with support coming in at 2682.

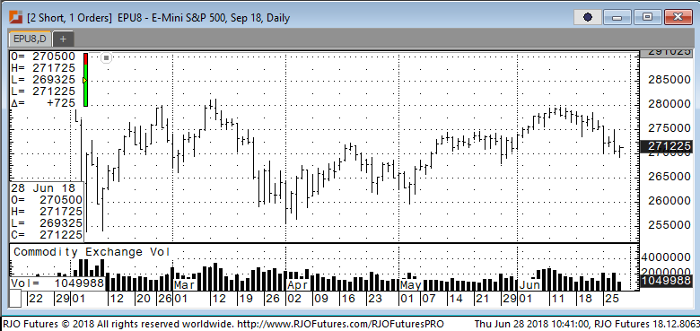

E-mini S&P 500 Sep ’18 Daily Chart