By Patricia Mosley, Natalie Denby and Bluford Putnam

In the first half of 2018, the U.S. Republican Administration launched a full-fledged effort to use tariffs as a weapon to protect U.S. manufacturing jobs and to force a radical re-write of trade pacts and tariff practices around the world. The response from the rest of the world, from China to Europe to Canada and Mexico has been tit-for-tat tariff increases on U.S. exports as well as shifts in buying habits away from U.S. products. While many parts of the U.S. economy will be impacted, U.S. agriculture has received the most attention as a potential target for retaliation. In short, whether the U.S. will be able to protect manufacturing jobs is not clear (and the subject for future research), but U.S. agriculture is going to pay a very high price. With U.S. agriculture in the spotlight for tariff and non-tariff retaliation, we focus our research on why soybeans will feel a much greater impact than corn.

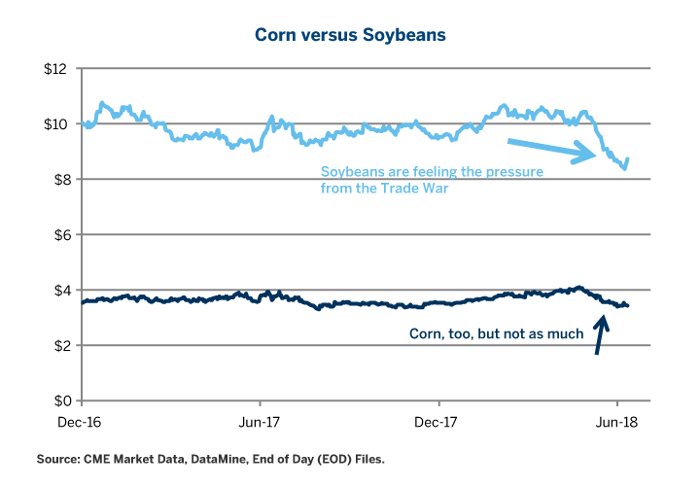

Figure 1. – Corn versus Soybeans

To anticipate our conclusions:

- U.S. soybean production and prices are at much greater risk than corn production.

- In the 2019 planting season, we expect corn to regain the lead over soybeans in U.S. acreage planted.

- Brazil and Argentina, will be the largest beneficiaries of trade retaliation against the U.S.-initiated trade war.

U.S. Corn and Soybean Production

In 2018, for the first time since 1983, the U.S. Department of Agriculture (USDA) announced that farmers planned to devote more acreage to soybeans (89 million acres) than to corn (88 million acres). Soybeans, which are the world’s largest source of animal feed and the second largest source of vegetable oil, are used in many ways.

About two-thirds of the total soybean crop is processed—or “crushed” into soybean oil and soybean meal; soybean oil is further refined and used in foods such as cooking oils, margarine and salad dressings, while soybean meal is a prime ingredient in high-protein animal feed for poultry and livestock.

When considering global trade flows, it is the use of soybean meal as the primary feed stock for chickens and hogs that really matters.

Despite corn’s popularity on the dinner table, in terms of usage, approximately 55-60% of the U.S. corn crop is actually used for livestock feed, and 35-40% is used to produce ethanol.

It is relatively easy for U.S. farmers to shift some of their acreage from corn to soybeans or vice-versa, depending on their expectations for future demand and possible price trends. Hence, our research focuses on several aspects of corn and soybean production – namely:

- Proportion of the global supply produced in the U.S.

- Concentration or diversity of buyers of U.S. exports.

- Ability of competitors to take market share from the U.S.

Global Supply and Export Competition

The U.S. accounts for a little over a third of both soybean and corn produced globally. The U.S. was behind 35% of global corn production in the 2017-2018 season (Sept-Aug), making it the largest corn producer globally. In the 2017-2018 season, U.S. soybean production was 35% of global production. We note, though, Brazil is a close competitor to the U.S. in terms of percent of global soybean production.

Much of what the U.S. produces is exported, particularly for soybeans. U.S. exports of soybeans accounted for 47% of total U.S. production in the 2017-2018 season. While corn exports from the U.S. are considerable, they amount to a smaller share of total U.S. production, around 15.7% in the 2017-2018 season.

U.S. soybean exports are more concentrated than corn in terms of buyers, making soybeans more vulnerable to tariff retaliation. China is the single largest buyer of U.S. soybeans, accounting for 57% of total U.S. soybeans exports in 2017 by value, according to the Commerce Department’s estimates. This concentration of exports gives China power to inflict damage on U.S. soybeans.

By contrast, corn exports are more dispersed, with no single buyer representing a majority of the purchases. Major buyers of U.S. corn include Mexico and Japan – exports to Mexico were worth 28% of total U.S. corn exports in 2017 by value, according to the Department of Commerce; Japan, the second largest buyer, had 22.5% of the total.

Ability of Competitors to Grab Market Share from the U.S.

The competition in production is more considerable for soybeans than for corn. Brazil and Argentina are major soybeans producers, and both stand to benefit from retaliation against the U.S. Brazil is expected to be the world’s largest soybean producer in the 2018-2019 season. In the 2017-2018 season, Brazil produced 119 million metric tons, compared to 119.5 million metric tons in the U.S. Argentina produced 37 million metric tons after suffering a major drought, and we expect Argentinian production to increase materially in the next season as the drought abates with the return of an El Niño. As Latin American competitors gain market share in global soybean production and prices of U.S. soybeans decline, we expect future crop acreage in the United States to shift toward corn and away from soybeans.

The U.S. faces competition in corn production as well, from China, Brazil, Argentina and the European Union, but this competition is not quite as substantial as the challenge Brazil poses to U.S. soybeans. While China is the largest corn producer after the U.S., China was responsible only for some 215.89 million metric tons in 2017-2018 season, compared to the U.S. production of 370.96 million metric tons. The next three biggest competitors to the U.S. lag far behind, with Brazil at 85 million metric tons, the EU at 62.1 million metric tons, and Argentina at 33 million metric tons in 2017-2018.

Bottom Line

- U.S. soybean prices are at much greater risk than corn prices from trade war retaliation due to the larger global market share of soybean exports from the U.S. compared to production, and relative to corn.

- In the 2019 planting season, we expect corn to regain the lead over soybeans in U.S. acreage planted. Uncertainty over 2019 acreage planting decisions is likely to be exceptionally large and to increase the volatility of futures contracts maturing in 2019.

- Brazil and Argentina will be the largest beneficiaries of trade retaliation against the US-initiated trade war since they are in the best position to increase exports to China.

Hedging the Trade War

The United States and China have fired the first salvos in their dispute over trade, imposing tariffs on a range of products. U.S. soybeans are in the eye of the storm and are experiencing heightened volatility. Hedge against the volatility and uncertainty with CME Group’s weekly Agricultural options.

Request your copy of Trading with Weekly Options with RJO Futures guide now!