December corn continued to consolidate yesterday sitting near Monday report day settlement price of 388. Corn is up over 17 cents on the week right now. October supply/demand report next week and short covering has been active ahead of this report. Export sales came in at 562,600 tonnes for the current year and 2,500 for the next marketing year. This is on the low end of report estimates. As of September 26th, cumulative corn sales are only at 18.7% of the USDA forecast vs a 5-year average of 28% at this time of year. Japan has bought 1.17 million tonnes this year compared to 0 last year. The Trump administration is expected to formally reveal biofuel policy changes today.

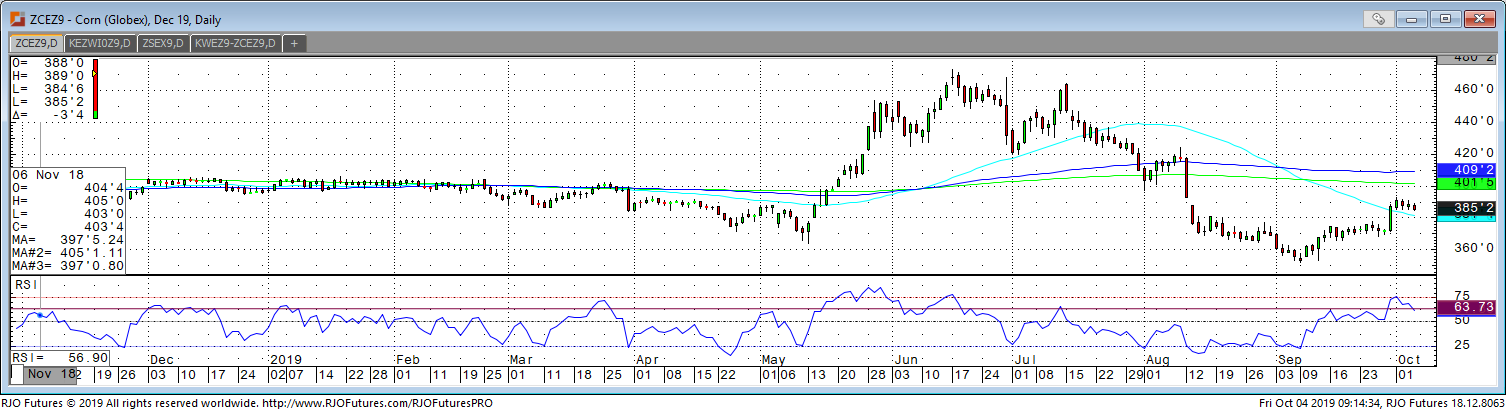

December corn continues to hold above the 50-day moving average at 382. Harvest progress has been slow due to wet conditions in the western belt, but early results are disappointing. The market continues to see short covering which could extend into next week. Resistance comes in at 391 and 393 with support at 386 and 383.