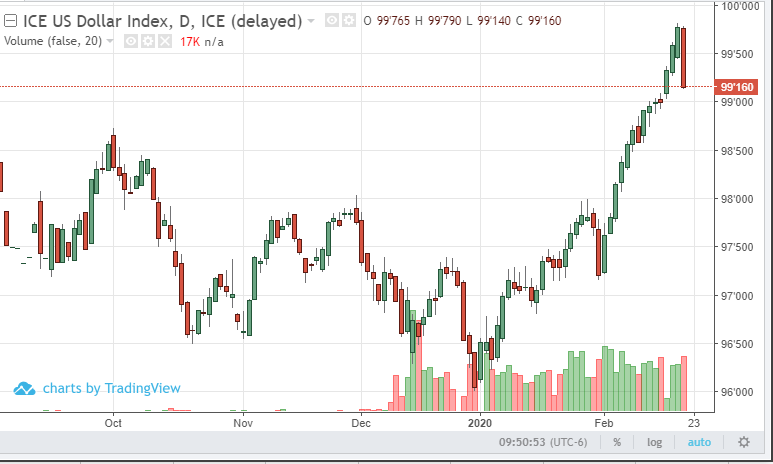

The U.S. dollar index is under strong selling pressure Friday morning, trading 60 points below Thursday’s three-year high. After the parabolic run higher since the turn of the year, it is not surprising to see the market take a breath after this morning’s PMI number missed expectations, coming in at 48.6 vs 52.5 consensus. Depressed foreign currency futures are making a run higher in response to the dollar trade. Notable leaders are the European currencies, with the euro, the pound, and the Swiss trading 0.63% higher after better than expected PMI readings from both Britain and the EU. The technical action is indicative of reversals if these moves hold into the close. First support was broken in dollar index, which projects trade down to the 98.69 area. The prospect for additional rate cuts this year is pressuring the greenback, with odds of a cut at the April meeting now at 33% according to the CME. Should stocks see downside follow-through, talk of rate cuts will be more prominent and USD bears will roar more loudly. The Japanese yen is the weakest of the currency futures after Japan reported a Q4 GDP contraction of 6.3% this week.