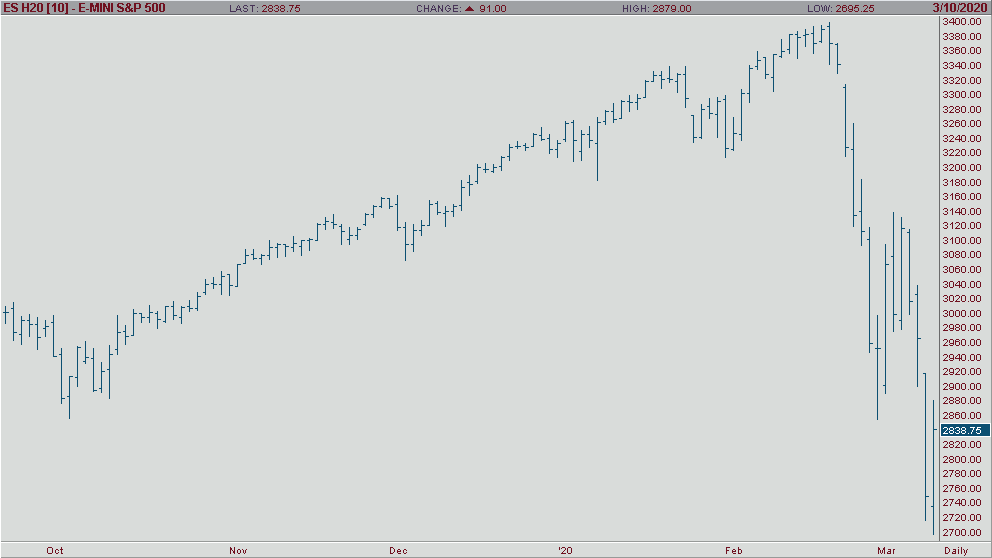

U.S. stock futures look to be recovering after Monday’s abysmal day, which included the largest one-day percent decrease since 2008. The S&P 500, Nasdaq, and Dow all shot higher in the overnight and don’t show signs of slowing down this morning. Many believe that the news from the White House stating stimulus assistance could be on way is what is causing this current spike. At the time of this writing, U.S. equity futures are up 4% and could go even higher. Treasury yields also seem to have recovered a bit but are still hovering around record lows.

As we all know by now, the culprit to all this recent turmoil is the coronavirus, or Covid-19. Unfortunately, this beast shows no signs of slowing down. With cases on the rise, countries are doing everything they can to stop or slow the spreading. On Monday, Italy cancelled all professional sports effective immediately and going until April. The threat of a global pandemic has stopped everybody in their tracks and halted travel. At one point on Monday, the price of a barrel of crude oil was less than the price of a family bucket of chicken at KFC. We could be seeing more Fed rate cuts soon as markets have priced in a nearly 50% chance that it happens. Stay tuned for updates.