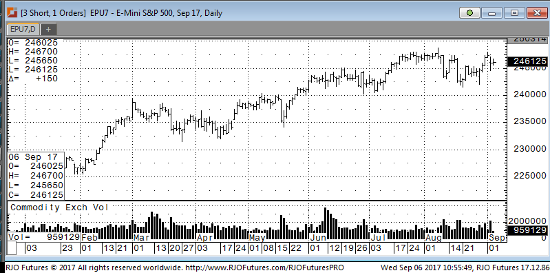

Global markets have found their footing, but have been unable to shake off lukewarm risk sentiment coming into this morning’s trading. The Shanghai composite finished near unchanged levels, the Nikkei 225 posted a modest loss, and Japanese equities continue to be pressured by safe-haven inflows to the yen. Australian GDP was in line with forecasts, while German factory orders fell short of trade estimates. European shares are under moderate pressure this morning and led by weakness in the UK FTSE-100. The North American session will start out with weekly private surveys on same-store sales and mortgage applications. With so many short term factors to spark economic uncertainty, the market looks vulnerable to see lower values ahead. Traders are getting nervous over the many steps the US congress needs to take in order to “not” disrupt financial stability. In addition, Hurricane Irma brings about new financial uncertainties due to the size of the storm and likely costs of damage and productivity. Given the disruptions and uncertainties over the debt ceiling, investors tend to get nervous that many stocks are priced for perfection, which could lead to a technical correction, and possibly a more significant correction. Watch for more back and fill action in the S&P. Short term resistance is at 2466 and 2470 with support coming in at 2443 and 2431.

Sep ’17 Emini S&P Daily Chart