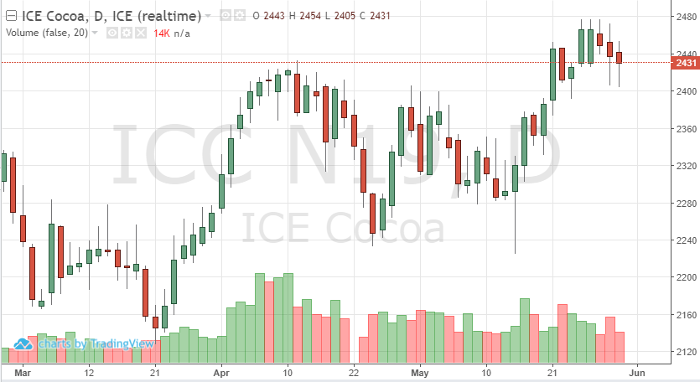

Due to the uncertainty in the global markets, many cocoa traders are taking the wait and see approach. With trade tensions stemming from the U.S. and China talks, the futures markets, specifically the softs and grains, are being affected. Unlike the grains, cocoa is consolidating. Many other markets have seen volatility, but the soft has decided to do the opposite. With demand weakening, and Asian demand potentially being weaker due to the unknown, some traders are staying on the sideline. The pound and euro are also causing this recent trend as well. The chart is showing that small pullbacks could be good buying opportunities. We are seeing higher lows and tightening on the chart. If consolidation continues, a breakout is due. With a potential new range in the July contract of 2430 to 2480, 2500 is insight again. If this resistance could be broken and bullish demand news breaks, look for new highs in cocoa.

Cocoa Jul ’19 Daily Chart