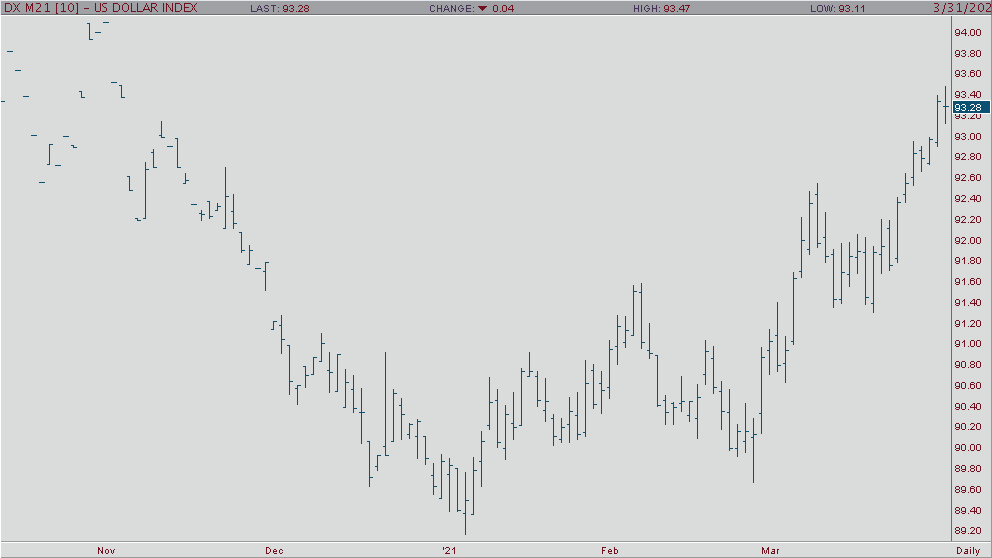

With the USD forging another upside breakout, the market has now filled a gap left by the early November sell off in the USD which in turn could signal an extension to 94.00 level. However, in the event that the USD shows any weakness following favorable US economic data, which includes jobs related data, todays action could be a very valuable trend signal. The bias is up in the USD, but data could present a reversal of a market that is extremely overbought right now. Technical indicators have risen into overbought territory which will tend to support reversal action if it does occur. A positive signal for the trend in the short term was given on a close over the 9-day MA. The next area of resistance is around 93.50 and 93.70 with support coming in at 93.00 and 92.75.