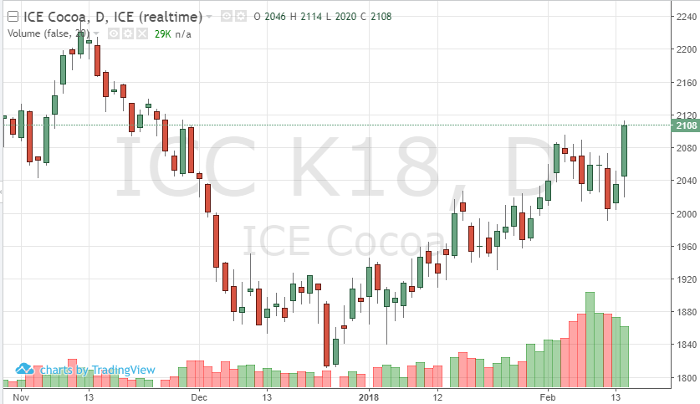

Futures, equities, bonds, cryptocurrencies – you name it, they all have been volatile over the past few weeks. Uncertainty about inflation and a wide trading range in the US equities has carried large moves into most commodities. Cocoa is entering a new range and may finally be breaking above the 2100 mark in the May contract. Demand has strengthened, supply concerns are present. Dry weather in key growing regions may damage future crops. The euro and pound have gained momentum helping the demand side of the cocoa equation. In the short-term look for the technicals to guide the trade. 2115 is resistance, 2085 is support. As we head into the US holiday weekend ICE cocoa has closed above the 9-day moving average turning this market bullish. Look for outside markets to give the cocoa some additional guidance.

Cocoa May ’18 Daily Chart