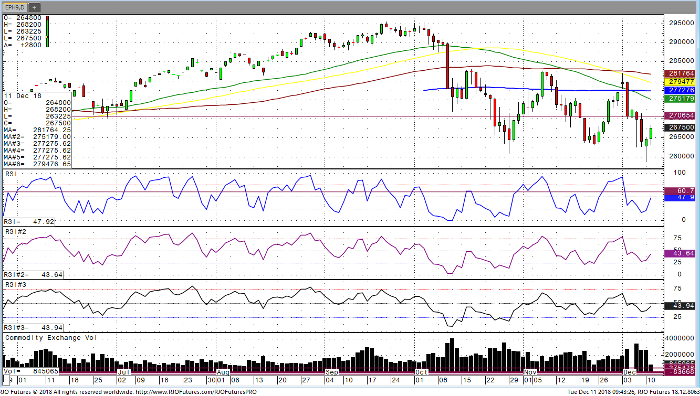

Volatility continues to be evident in the S&P market with a new low being established yesterday as we hit 2586.7. The market did however manage to rally closing the day at 2646 and capping off a stunning reversal. One could argue that an island reversal occurred, meaning a new low for the move and close higher for the day. As we look at the markets today, the S&P is up $29 at 2672 and reached as high as 2678 earlier in the morning. I am a bit skeptical at this point in time to say we are in a bull move because there are many headwinds still present like: China, Brexit and the continued breakdown in two major sectors of the market.

Financials and Tech are firmly in bear market territory and until proven otherwise, these rallies should be sold. Another big reason we are up this morning is the fact that President Trump tweeted that talks with China to end tariffs are going well. The last few weeks many tweets that have come from POTUS pertaining to positive talks with China and have led to a strong rallies only to fizzle out later in the day or the next, meaning no follow through. He seems to tweet out China related news on days that market is down big and or during times of extreme volatility. My best hypothesis on ongoing trade war is pretty simple. I feel it’s nearly impossible to get trade deal done in 90 days when this has been going on for many years, so I am very skeptical every time POTUS says great things are happening with China.

E-Mini S&P 500 Mar ’19 Daily Chart