Markets reacted poorly after the FOMC meeting yesterday, as equites continued to sell off, traders took a risk-off approach. Gold futures climbed, most commodities turned red though. With only 2 Fed hikes being forecasted now for 2019, traders tried to interpret the “hawkish” vs “dovish” hints that followed the minutes.

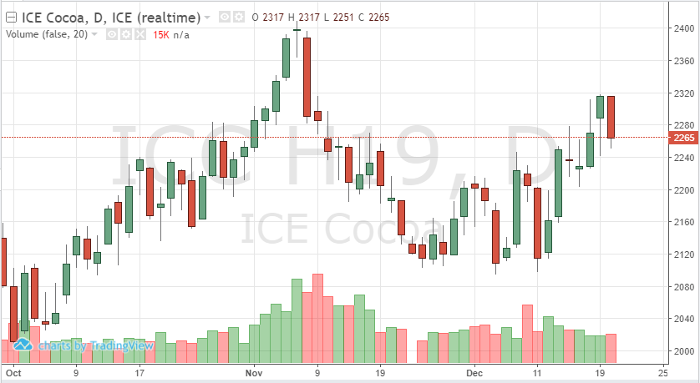

The March cocoa futures chart looks to be moving higher the last month of the year, but decided to sell-off after the market digested the information provided yesterday. The Euro has moved higher, giving cocoa some support and the potential for the demand side of the equation to recover but this will most likely take some time. Production levels have also given some support but the main factor, global risk, continues to steer commodities.

Weather premium could help prices, El Nino is headed towards cocoa’s key regions in the next month or so, dry fronts are headed towards West Africa and little to no rainfall. If production levels drop early in 2019, prices should test 2400 again before the March contract roll.

Monitor the 2250 level for some technical guidance. A move above 2320 should help cocoa get back on course.

Cocoa Mar ’19 Daily Chart