Same story all season; a weaker demand tone seems to be offsetting potential losses from the storm last week, which led to consolidation this week. Traders remain concerned about yield damages done to the crop from last week’s storm in North/South Dakota and Minnesota. Analysts are predicting 150MB to 400MB of lost production. News about the USDA re-surveying these states also added uncertainty to the market. If we lost the 400MB, this would put ending stocks at the lowest they’ve been since 2013. South America is experiencing delays in planting due to dry conditions, which could add a little support to the market today. Yesterday’s ethanol number was slightly negative, coming in at 971,000 barrels per day. Up .8% from last week but down almost 4% from last year.

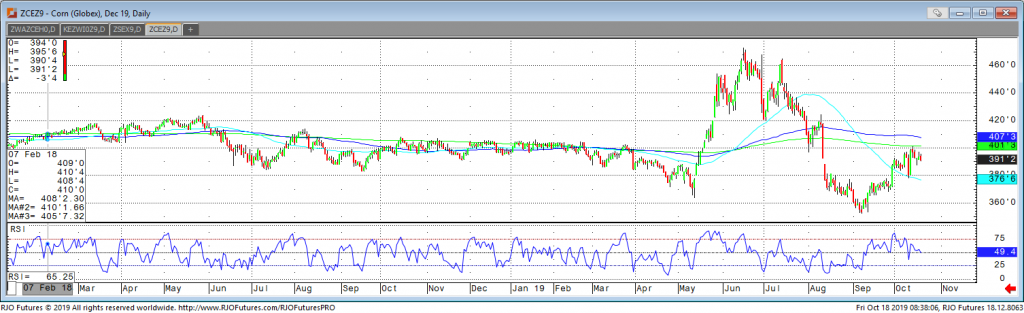

December corn is down 3-cents on the week and needs a close over 397 to mark the fourth consecutive weekly higher close. The weather heading into the final stretch of harvest is looking better with a drier outlook. However, enough uncertainty about yield and harvest should support pullbacks and keep them shallow. Resistance is at 397 with support coming in at 392.