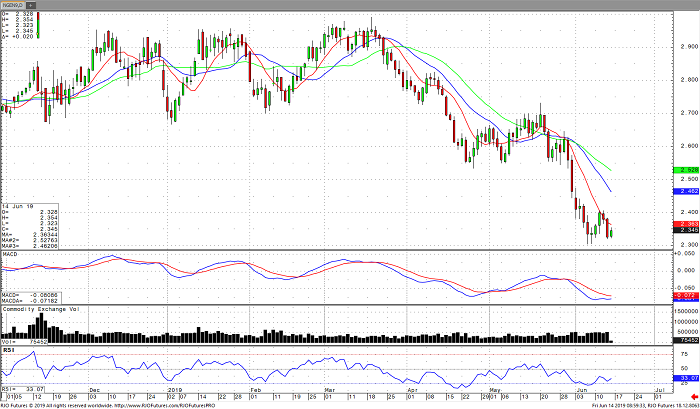

July natural gas is in a downtrend. There is a bottom just above the $2.300 handle. Momentum studies are at lows and are starting to turn up, this may increase the price as resistance is broken. The pivot is near $2.340. Resistance comes in at $2.359 and a close above $2.500 should change the trend. Support is just above $2.300 with a double bottom at $2.306.

Natural Gas storage came in below the expected injection for the week, the forecast was 110 bcf the actual number came in lower at 102 bcf. Based on the numbers alone, this should be a bullish scenario, but the total storage is 10% below the 5-year average. Weather forecasts lean bearish with normal to slightly above average temperatures over the coming week. However, being this near the lows, you may pick the direction of the market correctly, but the reward might not be the greatest. Letting the market pick a direction might be the safest play right now. You might leave a little on the table to gain a much bigger and safer move to the upside.

Natural Gas Jul ’19 Daily Chart