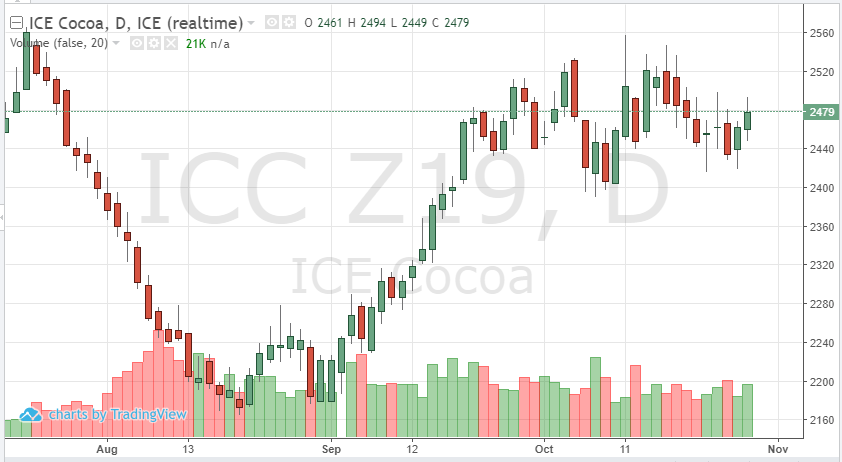

Current weather conditions are supporting cocoa prices. Rain in key growing regions could cause supply issues. The ongoing concern with global demand is also causing prices to consolidate and trade in a range. 2495 has held as resistance.

Global risk sentiment has added to volatility in currencies, which has carried over to cocoa prices – the Pound and Euro are the two main contributors.

If dry weather returns in West Africa after this recent rain, new crop cocoa beans could have some disease and damage, this could propel futures’ prices over 3000. This will be critical as traders begin to roll from the December to March contract over the next few weeks.