Posted on Sep 26, 2022, 08:18 by Dave Toth

While the 240-min chart below shows the market trading at the highs of the day after posting an all-time new low overnight below 1985’s 1.0463 low, this market has yet to confirm the first of our three reversal requirements on even a minor, intra-day basis needed to even defer, let alone threaten the secular bear market. MINIMALLY, the chart below shows a minor low and former support-turned-resistance at 1.1233 from Thur that it would be required to recoup to jeopardize the impulsive integrity of the decline from even 13-Sep’s 1.1740 corrective high, possibly introducing the early stages of a base/correction/reversal-threat process. Per such, we’re defining 1.1233 as our new short-term bear risk parameter from which shorter-term traders with tighter risk profiles can objectively rebase and manage the risk of a still-advised bearish policy and exposure.

On a broader scale, only a glance at the daily (above) and weekly (below) charts is needed to see the magnitude of this secular bear trend that remains down on all scales. Perhaps the long-and-major-time-wrong BULLISH exposure by the Managed Money community has finally come home to roost with the overall market forcing the capitulation of their bullishly-skewed positions into the teeth of a secular bear market. For whatever reason and DESPITE a massive bear trend, our RJO Bullish Sentiment Index shows a multi-QUARTER high of 68% just a month ago and a still-benign level of 57% from this past Fri’s update, a HIGHER level no less from the week before, that evidences this managed money community’s bucking of the clear and major downtrend. This stubbornly bullish exposure in the face of a clear and present and major bear market may have finally been the result of their bloodletting. It’ll be interesting to see this Fri’s RJO BSI update.

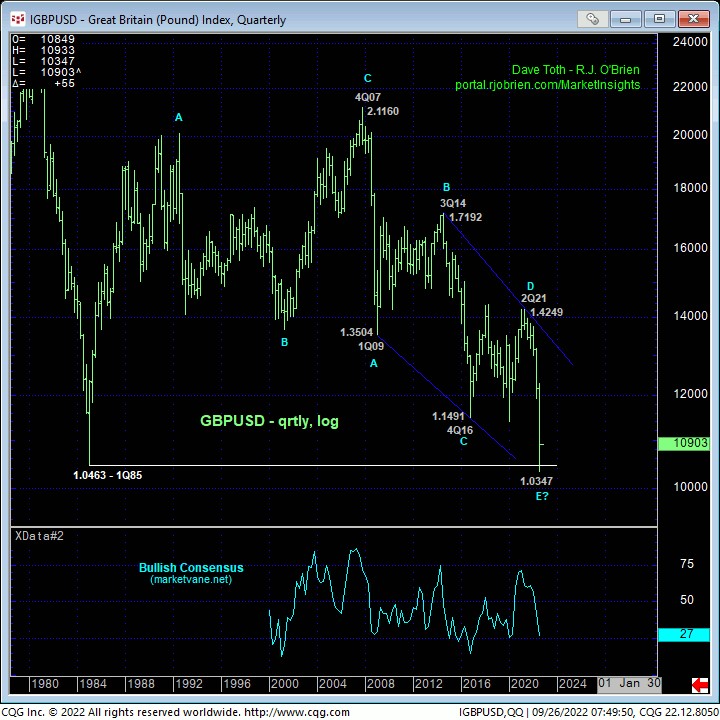

The quarterly log chart of the underlying cash market shows the GBP poke overnight below is all-time 1985 low of 1.0463. That previous secular bear market back in the ’80’s ended violently. We cannot ignore a repeat this time around as some may think this current assault at parity is another 35-YEAR bargain. A major bottom is inevitable somewhere along the line, and herein lies the importance of the risk parameters at 1.1233 and especially 1.1740 discussed above. But a recovery above these levels is required to satisfy only the FIRST of our THREE KEY reversal requirements of a bullish divergence in momentum. The second and third requirements- proof of trendy, impulsive 5-wave behavior on the initial counter-trend rally and, most importantly, proof of 3-wave corrective behavior on a subsequent relapse attempt- will remain to be satisfied thereafter before navigating what would be a very opportunistic base/reversal environment may be considered objectively. Until and unless these requirements are satisfied, recovery attempts are still advised to first be approached as corrections within the secular bear trend.

These issues considered, a bearish policy and exposure remain advised with a recovery above at least 1.1233 and preferably 1.1740 required to pare or neutralize exposure commensurate with one’s personal risk profile.