We have seen steady price growth for Jun ’19 crude oil contracts after prices hit a low of about $44 per barrel in late December. There has been strong fundamental data consistently driving futures prices higher with major producing and exporting nations restraining production, and a decline of several oil rigs in the U.S. working affecting supply. Some recent bearish news includes a jump in this week’s EIA crude stocks inventory reading, and a petty threat from our “dear friend and ally” Saudi Arabia to stop using the U.S. dollar to denominate prices of their oil has caused slight corrective action. With the U.S. economy continuing to flex and show its strength coupled with hints that we are near completing a trade deal with China, it’s my opinion the strong fundamentals still in place and good potential for a big rise in demand should continue to see this bull trend chug along until we see significant negative headlines.

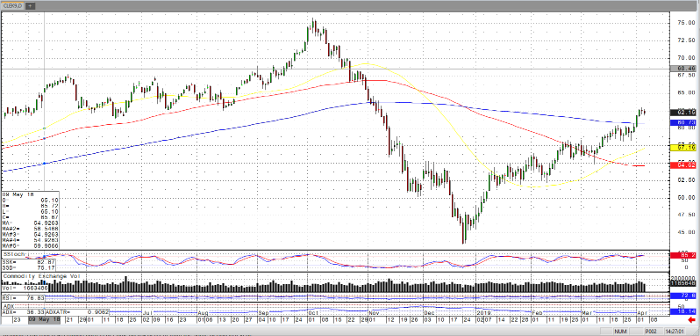

Crude Oil Jun ’19 Daily Chart

If you would like to learn more about energy futures, please check out our free Fundamental of Energy Futures Guide.