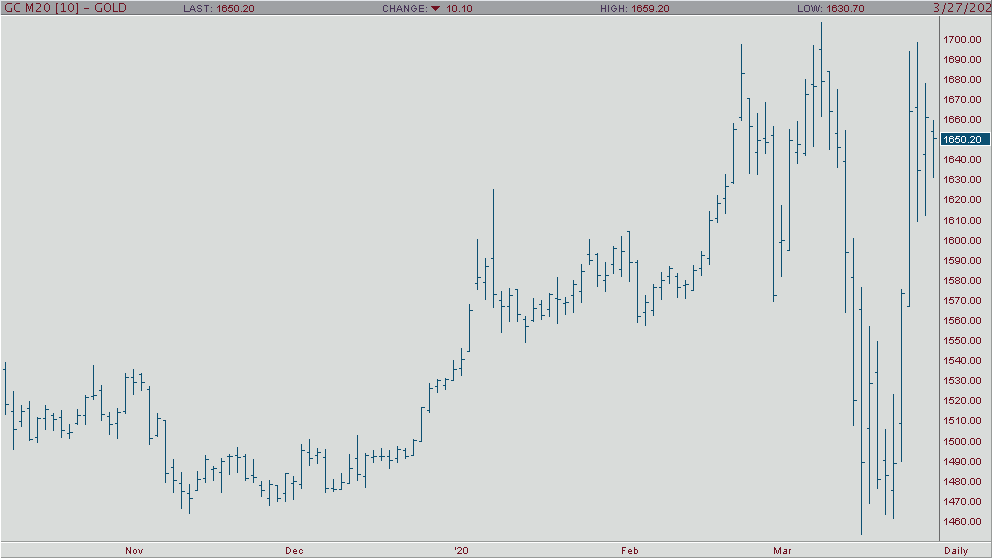

In the early morning trade, gold has pulled back even more from its weekly highs of $1,698.0 and is currently trading at $1,635.0 a troy ounce. June gold has been in the negative for the whole overnight trading session as investors will have to decide with global cases rising overnight along with the U.S. passing China (if you believe them) and Italy in total cases of the virus if it’s going to continue to be a safe-haven trade/investment, which is being fueled by anxiety. After being in the red all week, the U.S. dollar is finally in the green, which might cause gold to trade around these levels, but with the $2.2 trillion-dollar relief bill expected to pass the House today we might see a reversal of these two markets. When the bill passes, you would think eventually gold would continue this rally on fears of inflation down the road and it would be valuable to note that even with the shiny one pulling back from its highs that gold is still on track for its biggest weekly gains since the subprime crisis. Furthermore, you would expect the greenback to sell-off due to the largest stimulus package in U.S. history.

I usually say let’s look at the daily gold chart, but this is NOT a technically driven market currently. However, let ‘keep it simple and note that this week’s low is $1,608, which could act as support, and if it breaks the $1,700 an ounce levels, hold onto your longs and enjoy the ride!