In the early morning trade, the shiny one is up towards the weekly highs again and trying to break out and above the $1,755 resistance level. While Morgan Stanley announced that investors might scale back in buying gold for “fear based” reasons as the economy continues to recover from the Coronavirus lockdowns; however, they also extended their prices up between $1,800 to $2,000 a troy ounce which may have helped gold pop off its overnight lows. Also, with Coronavirus cases spiking in the South west like Florida it could keep many “fear based” investors/traders alike to stay long gold. Lastly, after over 40 million Americans were just laid off in the past few months and the amount of stimulus that was used along with the amount of US debt added to try and stimulate the US economy, one can’t help to think these are reasonable gold price speculations.

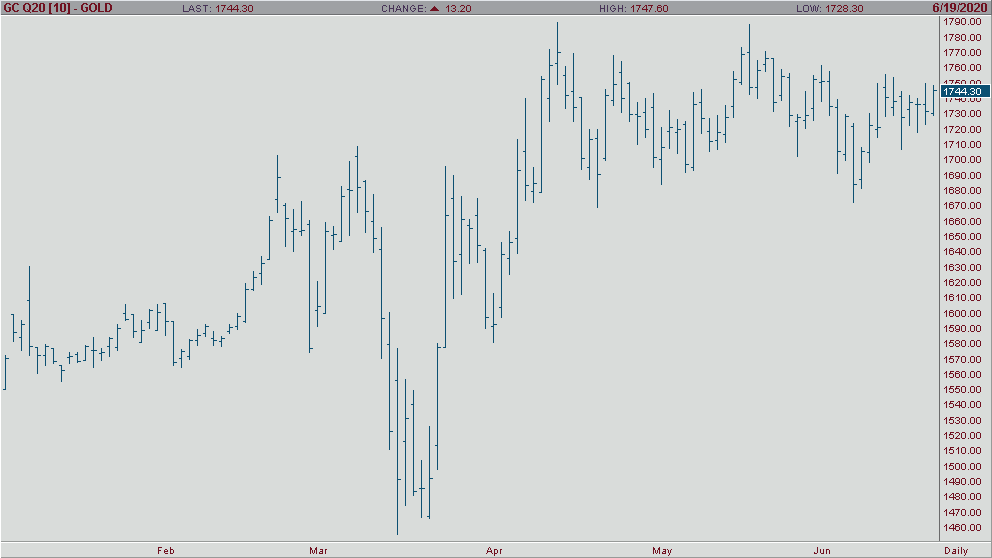

If you look at a daily August gold chart, you’ll clearly see that gold is still in a strong uptrend as long as it stay above this week’s low and if so, are prone to rally and test those levels mention above.