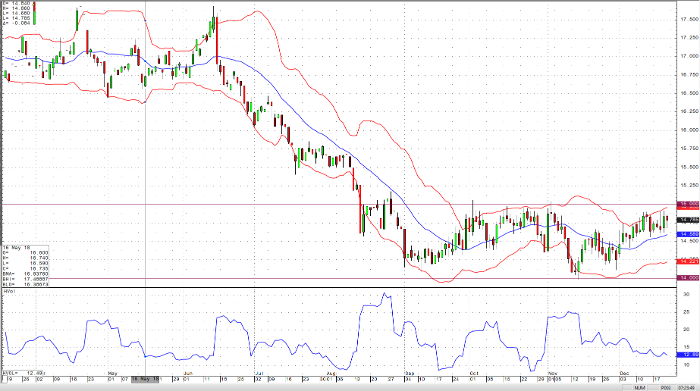

With a wild week in the commodities markets across the board, silver is rallying and approaching the $15 an ounce price level. With Wednesday’s move by the Fed making a quarter point increase on interest rates, it sent the dollar for a ride down and equity markets taking a very hard and volatile move down as well. Crude oil is not much better, posting major losses on the week. With the possibility that the U.S. and global economic growth may be slowing, this has sent money into a flight to safety mode, the gold and silver markets. But what do we make of it from here?

The 15 level is resistance in the March silver contract. However, the fact that the rate was raised this week may have tempered the outlook next year in the amount of rate increases. Due to this dovish attitude, I feel it has sent the dollar index lower, while also making a benefit to gold and silver. I certainly believe we will test the $15 an ounce area soon even though gold continues to outperform silver as the gold/silver ratio above 85 still, however, this is historically at the high end of the ratio. I feel silver will be seen by other investors as a bargain metal to reduce risk while providing a safer and cheaper instrument to invest some funds, especially those that have reduced their equity holdings and for investors abroad who find it somewhat a cheaper investment that is tied to the U.S. dollar.

Silver Mar ’19 Daily Chart