In the past 8 cattle trading days we have seen traders try to push the price of the April fat cattle back to the contract high of 129.475. One of the factors supporting prices was; the winter weather and storms that rolled through the Midwest which caused limited weight gains, weight gains that are much needed for when the cattle go to market. A consequence of this is that the lack of weight gain for the cattle may cause some of the ranchers and feedlots to hold back some of their herds resulting in a higher supply to the market for the back-month contracts. Along with the weather, the possibility of the government not shutting down increases consumer confidence creating a boost in consumer beef demand. With all that news happening in the previous 7 trading days leading up to yesterday’s sell-off, it could have been seen as profit taking, but when you look at the lack of packer bids yesterday it does raise the question, is the demand as strong as it was from the beginning of last week? Or are we starting to see a lack of demand causing downside pressure against the price movements that saw gains from 6 of the previous 7 trading days.

USDA boxed beef cutout values were up 65 cents at mid-session yesterday and closed 28 cents higher at $217.16. This was up from $217.02 the prior week. The Commitments of Traders report for the week ending January 15th showed Managed Money traders added 2,818 contracts to their already long position and are now net long 98,557. CIT traders reduced their net long position by 4,982 contracts in just one week to a net long 133,503 contracts. Non-Commercial & Non-Reportable traders added 4,954 contracts to their already long position and are now net long 100,344. In my opinion, the lack of weight on the cattle is a bigger market mover to the upside rather than a possibility of a shutdown and lack of demand from the consumer for the time being. A break above yesterday’s high (128.450) indicates a continuing increase up to the 130.000 level, creating a new contract high.

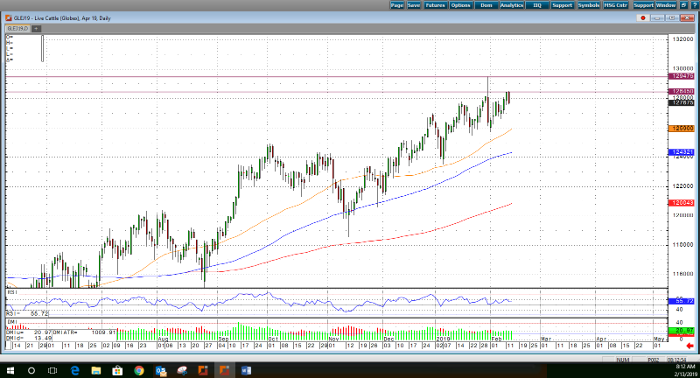

Live Cattle Apr ’19 Daily Chart