This week the EIA Petroleum Status Report showed US oil producers ramping up productions, with a build in inventories of 6.2 million barrels. This comes as a sizable increase compared with last week’s build of 2.2 million barrels, and supports the notion that US oil producers are continuing to offset the cuts in production from overseas. The increase in US oil production has come alongside a week over week rise in US refining, to 91.1% of full capacity, up 0.3%. It’s also being reported that US pipelines are at full capacity, and unable to move oil from fields to refinery at the rate of oil production. I have mentioned in the past, the $60 to $65 price per barrel threshold is significant for many (both within US, and abroad) producers. Now that WTI crude prices have broken above multi-year highs, and the psychological price barrier of $66 is likely to be tested as support, and that has continued to hold as the low end of the $3.00 range. It’s worth noting that the current run up in crude prices could be the result of pipeline constraints, where US shale oil fields are having trouble moving the product to market. This is generally because pipelines are at capacity, and with pipeline expansion projects in the works, WTI producers are having to rely on the more expensive means of trucking crude from fields to refineries.

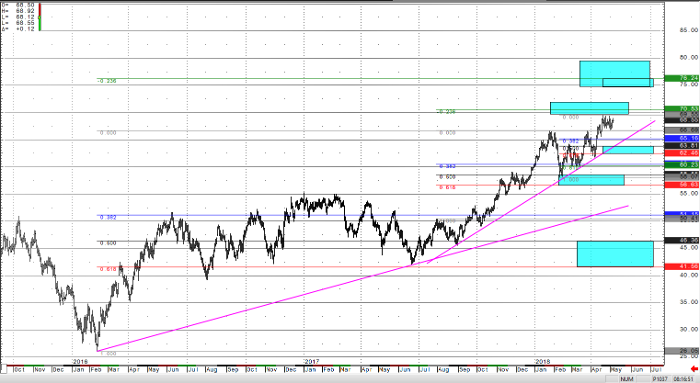

With a constraint in the ability to get oil out of production areas, the price of WTI crude seems to be supported in its range for now. While it’s still early, and some conditions are starting to suggest short-term over bought conditions, but with each selloff to the low end of its current range, those conditions seem to be unwound. While a Fibonacci support zone has already provided a bounce from the $58.50 to $58.00 inflection zone (blue boxes on chart are Fibonacci inflection zones), WTI crude futures have begun their climb towards these inflection zone targets clustered between $70 and $76 a barrel. If WTI crude prices break back into the multi-year range (below $65), traders can expect support into the $63.80 and $58.00 inflection zones. Before this situation can even be considered, WTI crude price would need to settle below $65.00 a barrel. Until then, expect buyers in the dips, and for the price of WTI crude to continue to test the $70.00 handle, and a break above could lead to a test of $76.00.

In my opinion, the rally that has taken WTI crude prices above the $66.66 continuous contract highs (into the end of 2017 and start of 2018) is still at the forefront of traders’ minds. There is a literal wrestling match over trend between the bulls and the bears, which ruminated for most of the month of April. While there are still the prior highs ($69.55) to break through, there may be an opportunity to position for the resolving push to test above $70.00 and hit those technical $76 upside targets. With WTI Crude prices above prior multi-year highs, the trend is up until it’s not – and I like to think, trend is my friend. When a market speaks, you must listen, and WTI crude may be telling us this is the beginning of a much larger trend being born.

Crude Oil Daily Continuation Chart