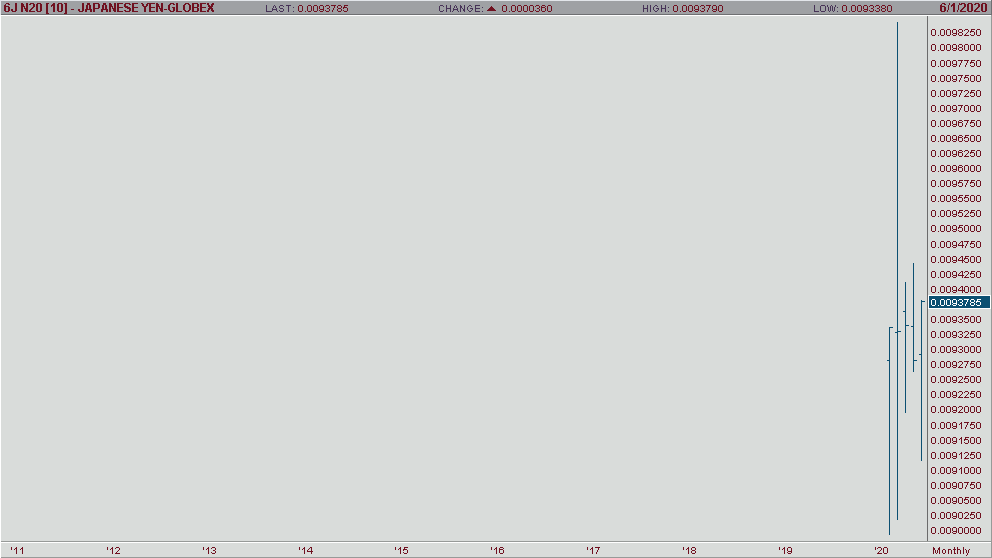

The yen has reached its highest point since May based on several news factors that have driven Asian market optimism. As OPEC agreed to output cuts on Saturday, June 6th, and U.S. jobless claims came out better than expected, the Asian markets began to see new life. The Nikkei 225 rose 1.2% on the seventh, pulling the yen along with it as the world economy was perceived to have new life. The yen has continued to rage on all the way through the eleventh, but will it continue? My analysis says it will into the foreseeable future. As U.S. policymakers have given a more pessimistic outlook on the pandemic recently, a slight pullback only seems natural; however, I still see yen future prices rising at an exponential level on the one-year-one-day chart. Considering this on top of U.S. equities erasing almost all losses incurred from the pandemic, optimism seems to be in great supply. There may be a few bumps in the road along the way, but I am long on the yen into the next 1-2 weeks.