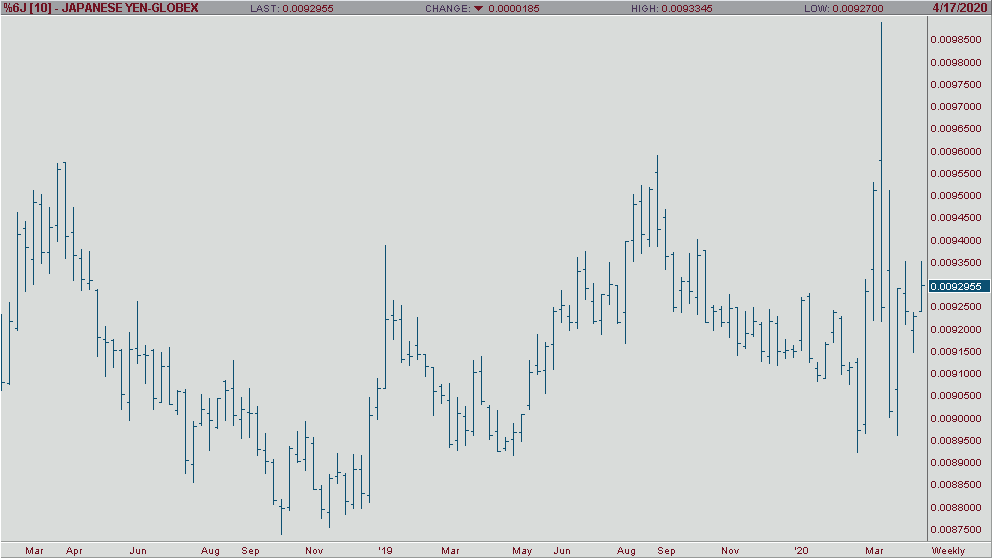

After the yen’s massive decline in value coming off of annual highs on March 9th, people are asking, “Will it regain its strength?”. With the United States Federal Reserve continuing to increase the money supply at an alarming rate, it seems like common sense that the yen will continue to strengthen against the dollar. What’s important to note in addition to this, however, is the relationship between Japan’s money supply versus other major economies. There is nearly no doubt at this point that Japan’s economy will shrink overall for the year 2020, much like the rest of the world’s, but the real question seems to be not only how it will shrink compared to other countries, but how it will shrink in relation to that company’s respective economic history. Economists of 24 private institutions project an average quarterly GDP shrink of 2.93% in Japan, coming to an annualized 11.72% contraction in GDP overall.

On the surface this certainly sounds dismal, but not when you look at this in context to other major economies. The Office for Budget Responsibility notes that GDP could plunge by 13% in the UK for the year 2020 and Goldman Sachs reports that the United States, the world’s largest economy, has the expectation that GDP will experience a 10% decline solely due to COVID-19. As the world now has its mind set on rampant quantitative easing measures, it is no longer shocking that the United States Federal Reserve has been so aggressive about economic stimulus. Currently, the world’s idea for remedying this solution seems to be pumping more currency into their respective countries’ economies, hoping they can pay their way out of a recession.

However, Japan has experienced occasions somewhat like this before, when in 2009 GDP shrank by 5.4%. For the US, however, GDP shrinkage of this magnitude, at least in the last 50 years, is generally uncharted territory. In 2009 US GDP shrank by 2.5%. The relationship between 2009 and 2020 projections are four times the effect on American GDP vs roughly only twice as much for Japan (5.4% vs 11.72% & 2.5% vs 10%). For this reason, I feel an overreaction is more likely to occur in US monetary policy.

There are still many unknowns in this unprecedented scenario regarding this pandemic, but one thing seems sure, our new mindset seems that the more a country is projected to shrink, the more aggressive the quantitative easing will be, and that aggressive QE will increase the money supply, which will in turn devalue their respective currencies. For these reasons, I project the yen will increase in value versus the dollar over the next several months.