The S&P has bounced this morning which continued a close yesterday about twenty points off their low. The main driver yesterday was a Fed official came out and stated that we might have to lower rates, which immediately put pressure on the dollar, yields and rallied stocks. The big negative for stocks going forward is the continued yield inversion where the 3-month bill is higher than the 10-year note, which if history repeats itself, is a very good predictor of a recession occurring in the next 8-12 months.

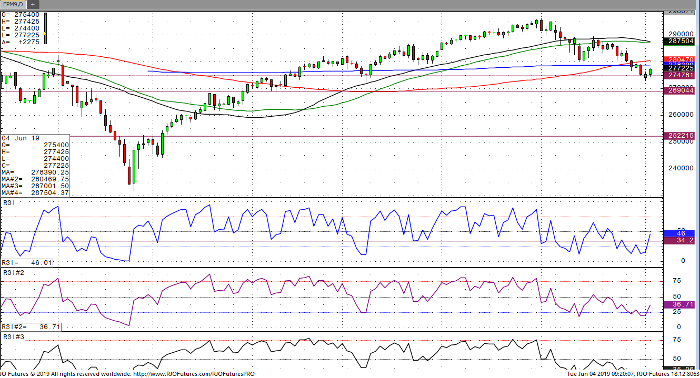

Looking forward to important economic news this week is the all-important employment number which comes out on Friday at 8:30 central time. The street is looking for 185K new jobs added vs last month 263K reading. Technically speaking, the number traders want to pay attention to is the 200-day moving average, which comes in 2784. Traders should look to sell rallies as we are in correction territory. Additionally, I see some minor support at 2728.75 which was yesterday’s low. As always, these markets are very fluid, and traders should always watch for fed officials that come on the tape and talk about rates.

E-Mini S&P 500 Jun ’19 Daily Chart