Global Equities: A relatively mixed bag around the world this morning, US trading slightly lower (off the overnight lows), Europe down all across the region with Spain leading -1.30%, and Asian equities higher across the region. Key earnings are due out in the US today, including the much lauded TSLA – which in our opinion has moved more on hope and FOMO rather than economic sanity, but who can even tell the difference anymore. Microsoft also reports after the bell.

Metals: Gold and Silver continued their climb overnight, Silver +6.50% last night at one point and once again outpacing Gold. Metals, specifically Gold are telling you that rates are going to be low, the Dollar is going to be weak, and expectations for inflation will be high well out into the future. Got that? Down rates, Down Dollar, up Gold. Metals are immediate-term overbought, as they were yesterday and the day before, look at booking some gains so you can replant your positions from the low end of our range, which is now north of 1800oz for Gold.

Oil- Trading down this morning on the larger than expected build in API inventories yesterday (+7M bbls w/w), which begs the question of the strength of demand. EIA report is due out today at 9:30 CST. There’s a topic on the table in the next stimulus bill presented by Mitch McConnel that would protect companies from employee lawsuits after returning to work. I happen to think this issue is very important for energy demand, as it would encourage companies to bring employee’s back therefore bolstering demand for fuel and travel back to work. I’ll tell you, from what I’ve seen the Chicago Loop is a ghost town during what used to be peak rush hour. Air travel fuel demand remains down 30% from last year.

US/China relations seem to be going “splendidly” this morning. The US has accused Chinese hackers of attempting to steal C19 vaccine intellectual property, and subsequently ordered the Chinese to close down their consulate in Houston Tx. Reports of a fire at the consulate this morning stem from rumors of the Chinese burning documents inside.

Stimulus– hearing that congress currently at an impasse on the next round of stimulus. Many of the benefits from the previous rounds of stimulus are set to expire at month end. Developing….

Long on patience, process, and Stagflation, short on FOMO. Good luck.

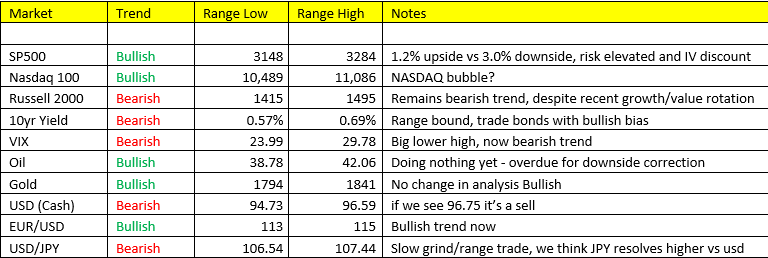

Actionable Levels

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.