A fairly action packed day today with Aug Retail Sales kicking us off at 7:30 CST expecting m/m +0.9% vs +1.3% in July. Of course the FOMC concludes its 2 day meeting today, where they’re largely expected to keep policy unchanged, but update there multi-year views of the economy. Jerome Powell will speak at 1:30 CST following the announcement. Global Stocks were mixed overnight. The US lead higher across the board, but Europe mixed to lower, and Asian equities broadly lower. Energy prices are higher, as Hurricane “Sally” making landfall as a cat 2, but mostly lead higher by the drawdown in the API energy data yesterday at 3:30pm CST. The Japanese Yen is the strongest currency on the board – now signaling immediate overbought – as Japan’s newly minted Prime Minister Suga take the post.

UPDATE: US Core Retail Sales m/m comes in soft at +0.6% vs +0.9% exp and +1.3% in July and Retail Sales y/y -9.0%

SP500 +0.52%, NQ +0.28%, Russell 2000 +0.73% to 1547.00

GER +0.01%, FRA -0.16%, UK -0.30%

Shanghai -0.36%, KOSPI -0.31%

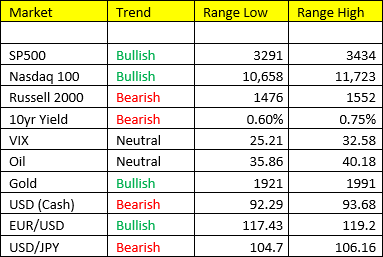

Early Review of Futures Markets

Metals:

*Gold Trading higher overnight +0.62% ….. I can’t stress enough to watch how Gold and of course the USD react following the FOMC statement/press conference at 1:00 and 1:30pm cst.

*Silver +0.59% – same analysis as Gold

*Copper is trading 0.02% to UNCH – following and immediate term overbought signal yesterday.

*Platinum made another healthy surge yesterday, and seems to be gaining momentum and fervor amongst the metals complex. Supply side issues and a widenting spread between Platinum/Gold and Palladium are driving forces for the “poor man’s” Gold. We’re bullish PL from the low end of our range of 936.00 oz.

Energy:

*Crude Oil (CL) +2.00% off of the larger draw in API private survey yesterday. Today we’ll get a look at the EIA (Government Survey) at 9:30am CST and compare vs API. Recently we’ve seen sizeable downgrades to consumption aka demand side fundamentals. Watch the 39.00 level carefully – this is our bull/bear line on Oil and will be very telling as to what to expect in Q4 2020 (more stagflation or growth/inflation slowing).

*RBOB Gasoline +1.32% with EIA production due up at 9:30

*Natural Gas: Neutralizing momentum on the 15% decline in prices w/w. Immediate oversold was triggered at 2.25 in October. Weekly momentum remains bullish trend and oversold. We think a near-term low is due, and we may have seen it. But be mindful of the chart damage that has been done following the 15% crash in prices.

Currencies:

*USD approaching the low end of our range. Its noteworthy that we’re getting a “higher low” in the range reading. We think there’s a rising probability the USD stabilizes here.

*Yen Futuress the strongest on the board +0.55% as the new Prime Minister takes over. Immediate-term overbought (not a short recommendation), but this could have more legs to the 96.00 level.