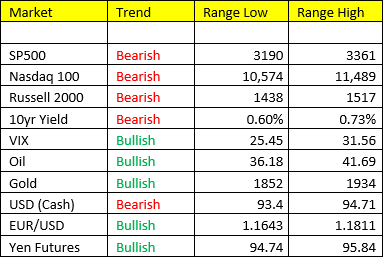

The Western World is waking up to big gains in the equity space this morning, with SPY +1.46%, NQ +1.85%, Russell 2000 +1.53%. Europe also had a stock ramp overnight with GER +3.12%, FRA +2.44%, and UK +1.29%. Reviewing last week, we saw quite the opposite as market attention turned towards the rising probability of another Scenario 4 (G/I Slowing) in Q4. More of the same via STAGFLATION in Q3 OR “Risk off” is the question we’re trying to answer ourselves, and to be frank, we don’t have the answers just yet. What we do have in our corner is our quantitative signals via or trend and range analysis, we’ll let those be the guiding light until we have a better grip of the Growth vs Inflation fundamentals.

ASIAN Equities: Shanghai -0.06%, KOSPI +1.29%

Notable Commodities Overnight:

*Gold/Silver signaled oversold last week, both markets bouncing to start the week +0.33% and +0.48% – likely going to need more reassurance of a second stimulus bill in Congress to continue to propel us, ALSO more down dollar. Likely a trade back to 1900 in the near-term, and needs to recapture 1875 as its first hurdle.

*Dollar starts off the week on a downbeat after probing the top of our range for 4 consecutive sessions, -0.41% to 94.24.

*COPPER -4.3% last week and signaled immediate oversold down at 2.92 w/ near-term upside back to 3.03, the question here is also Scenario 3 (Stagflation) vs Scenario 4 (Risk off) that will determine the next major move in copper prices.

*Oil- same theme, down dollar on immediate overbought condition last week, helps push oil prices back up this morning. Upside potential to 41.72, oil back to bullish trend. We’re not doing anything in energy just quite yet.

*Stock Futures are going to open with less upside/more downside potential in our range analysis. Volatility of US Stock futures remain elevated with VIX >26.00 and VXN >32.00. Question: Can you short equities from the top of the range with volatility at the low end of the range? Can you do you that? Something we’re going to be considering.