Back to back heated inflation numbers over the past two day’s shouldn’t come as a surprise to any of us – June US Producer Prices +7.3% y/y and +1.0 m/m vs +6.6% and +0.8% previously in May. We also heard some dovish remarks made by Fed Chairman yesterday to Congress, attempting to quell any fears of a taper tantrum. Powell suggested that the labor market was not in a position yet to warrant immediate Fed action on a taper. Inflation has risen above the Fed’s expectations, but likely is “transitory” and yada, yada, yada. Today is day 2 of Powell’s testimony to members of Congress.

–Oil took a > 3.00% hit yesterday on OPEC reaching an agreement on production increases….furthermore, headlines this morning suggest that the US may be soon looking to lift sanctions on Iran, likely taking the first steps towards redrafting the Iran Nuclear Deal that was disposed of during the previous administration. Oil down another -1.55% overnight.

–US Initial Claims just hit the tape and fell 26K w/w to 360K – our view on labor trends remains positive and will likely continue to ramp up over the next few consecutive months. Rising wages in the monthly data we believe will be a key focus of the market in the next several labor reports, and also a contributing factor to the “sticky” inflation view.

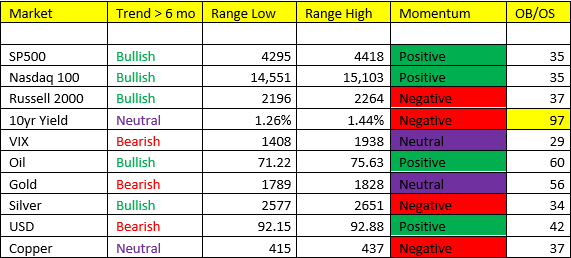

–Small Caps took a lick yesterday, -1.6%, extending losses from Tuesday. The Russell 2000 is the only major index carrying negative momentum, and is now triggering immediate OS.

Currencies- the USD tracking higher this morning, after another failed breakout attempt. We’ve mentioned the prospects for a period of upcoming Dollar strength, and further weakness in the Euro. The ECB meets next week, and will likely double down on their dovish pivot from June – pledging more aggressive PEPP (Euro QE).

Metals– tightening ranges in the metals = falling volatility. We own a small position and gold and are interested in grossing that up over coming weeks – silver too. However, gold is now beginning to give me “more positive” signals than Silver in terms of momentum changes. We’ll bring you more in coming days.

The game is getting harder, we’ve recognized this change in market dynamics over the past few months – and still believe we’re in a transition phase. Pay attention.