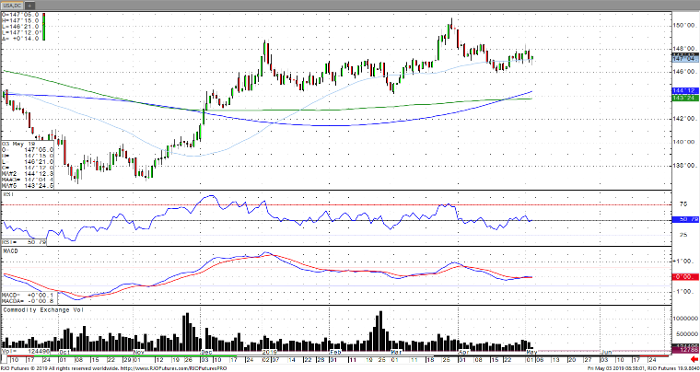

U.S. government bond prices are bouncing back in the early session following a better than expected jobs report with the U.S. economy adding another 263k, above expectations of 190k with wage growth largely muted. This comes amidst a downturn in prices following Federal Reserve Chairman Powell’s pressor in which he stated that the recent weakness in inflation was ‘transitory’ in nature. Yields initially declined after the Fed released its latest policy statement starting that inflation was operating below its 2% target, which was largely undercut by Powell’s remark. The Fed views the job market as strong, with wages expected to rise without a ‘strong case’ for raising or lowering rates. The benchmark 10-yr yield remains bearish trend with the today’s range seen between 2.44 – 2.63%. Near term resistance on the 30-yr bond is seen around 147-19 with support around 146-19.

30-Yr T Bond Jun ’19 Daily Chart