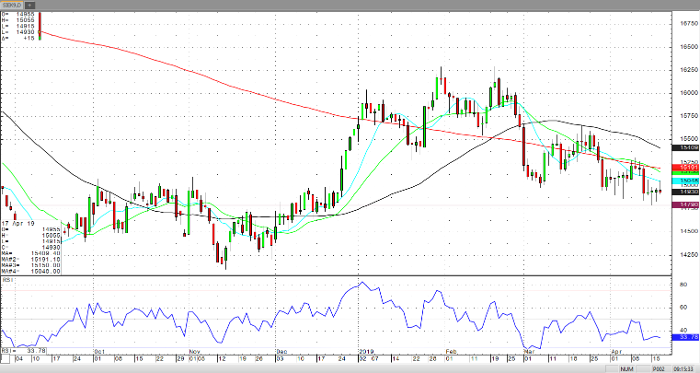

In my last article, I identified $14.75 as the next downside level to watch. This week’s low, so far, is $14.795 for the May silver. The U.S. equity markets continue to move higher and the dollar is still relatively strong. Silver and metals in general will have a tough time moving higher with so much strength in the equity markets. While the Fed remains dovish, they should also remain data dependent on Fed policy decisions. Recent data on CPI and PPI have been somewhat inflationary. Any hint of a rate hike in 2019 and the silver market will rally, and the equities will correct to the down side.

While the short-term trend in silver is still technically down, a little punch over $15.00 will quickly reverse the trend to sideways. While recent trade has been choppy the market doesn’t have downward momentum and therefore I see it as basing a bottom.

Silver May ’19 Daily Chart

If you would like to learn more about metal futures, please check out our free Fundamental of Metal Futures Guide.