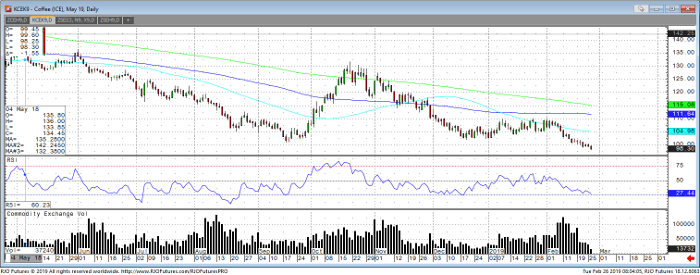

The market seems to be looking for a bottom here in coffee, but with great weather in Brazil, talk of continued flow of old crop coffee, and increasing open interest on the recent break is keeping funds on the short side. The Feb 5th COT report showed managed money traders were net short 49,136 contracts. If there is some positive technical action and resistance levels begin to give-way, coffee may see a large short covering rally, however the market still lacks the catalyst to spark a move like this. The recent jump in open interest would also suggest that fund traders are still adding to their net short positions. With RSI reaching 12, the market is technically oversold and has also seemed to price most of this good weather into the market already. Resistance comes in at 100.45 and 101.10 with support coming in at 99.20 and 98.65.

Coffee May ’19 Daily Chart