There are a couple of phrases that I’m constantly using when talking about the futures markets. “Grain markets like to trade their own fundamentals.” Simple supply and demand driven markets. My other favorite phrase is that, “it’s almost always just a level on the chart that stops, reverses or gives breakout momentum to a market.” Just look at the charts! That’s how everyone should trade. That’s how the large hedge funds and algorithm systems trade these markets. Charts are indicative of what is happening right now and that’s what traders react to. Fundamentals be damned!

However, markets like corn always come back to the “real” fundamentals of supply and demand for market direction in the longer term. Corn prices have been slipping lower for years now as we worked through huge supplies. Here in the US we have been consistently scaling back on planted corn acres as well. This is how a futures market is supposed to function. I believe that we are now at a tipping point on both US and global supplies. Global stocks to usage ratio is at a 45 year low and we haven’t had this low of stocks to usage in the US since 2003-2004 crop, and that was before ethanol usage.

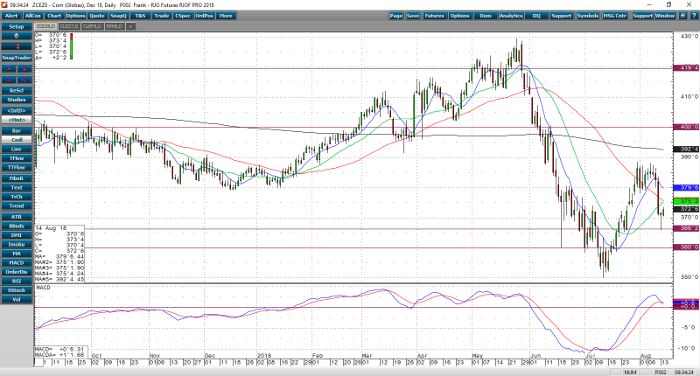

I expect that corn prices for December futures will easily retrace back to $4.00 and possibly even as high as $4.20 to $4.30. China has never been a big buyer of US corn. The market has over reacted. I do not normally condone buying into market weakness, however, in this case I think that corn is currently undervalued.

Corn Dec ’18 Daily Chart