No doubt the coronavirus pandemic has destroyed demand for commodities. But out of crisis comes opportunity!

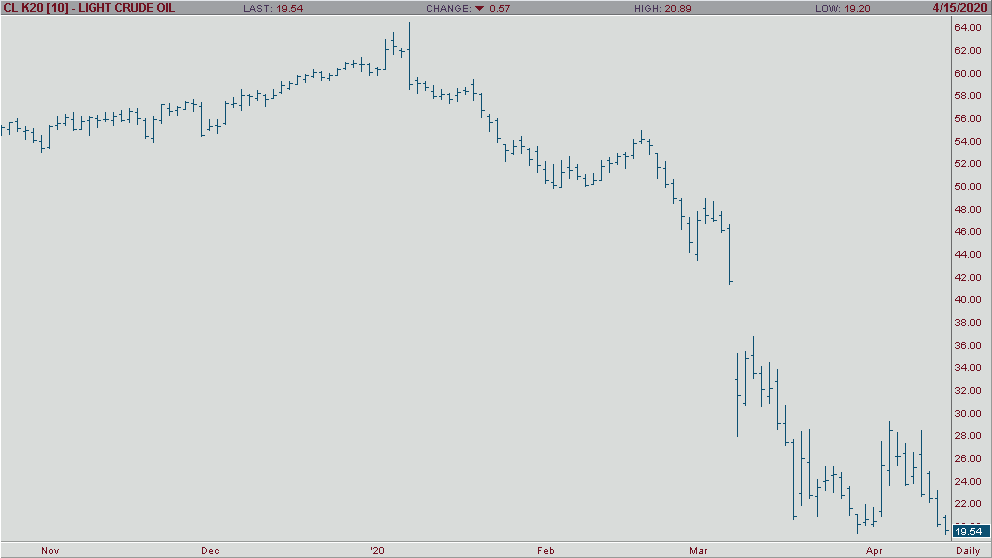

There are several very good long-term opportunities developing during this COVID 19 pandemic. None more obvious than what has happened to the crude oil market and gasoline. It’s not just the demand destruction from “shelter in place” orders. It’s mostly because of the price war between the Saudis and Russia. Global storage capacity is nearly maxed out. So, there’s no demand and we’re running out of storage space. No doubt it will take some time to work through this over supply. We cannot put a date on when demand will return, but it will.

OPEC+ deal to cut production may seem like too little too late, and it is for the very short term. However, the production cuts will have a significant impact on supply by fourth quarter, especially if we come out of this Coronavirus shock as quickly as believed we will. We may not get that V shape recovery, but we won’t let this recession continue into 2021 and by no means does it turn into a depression in my opinion.

While it is still too early to call for a bottom in crude, I do believe that there is a reasonable limit to how much lower that it can go. Clearly there is much more upside potential than downside risk.

Precious metals. Gold, silver and platinum are all good buys. Silver and platinum have more ground to cover as gold has been the leader, but I see more upside across the precious metals. There is no reason to believe that the Fed or any other Central Bank around the globe will raise rates in the foreseeable future.