Oil prices rose early Wednesday morning ahead of reports of declining U.S. petroleum inventories. Light, sweet crude futures was up for the second consecutive session, .9600 or 1.4432%, to 67.48. U.S. crude stockpiles fell 1,000 barrels last week, while gasoline and distillate inventories fell 2.5 million barrels and 845,000 barrels respectively, according to data released by the American Petroleum Institute. The U.S. Energy Information Administration will be releasing a report on stockpiles later this morning. Despite growing U.S output, which has most recently been noted by the increase in rigs drilling for oil, prices have buoyed over the past week by geopolitical risk to supply in the Middle East. Oil prices have climbed to their highest level in more than three years at the end of last week, ahead of a U.S.-led strike on Syria. Oil is looking ahead to the next meeting of OPEC and non OPEC countries to discuss options for further production cuts on Friday in Jeddah, Saudi Arabia. However, with Iraq consistently increasing oil production, it may become difficult to maintain efforts to curb output, specifically if oil prices begin to rise. It is widely expected that the U.S. could reinstate economic sanctions on Iran, which would continue to buoy prices. Momentum appears to have upside movement in the short term but coming close to overbought territory with resistance coming in at 67.43 on the day, which could propel prices to the 68 -70 range. The first level of support comes in at 65.90 and 65.18 respectively.

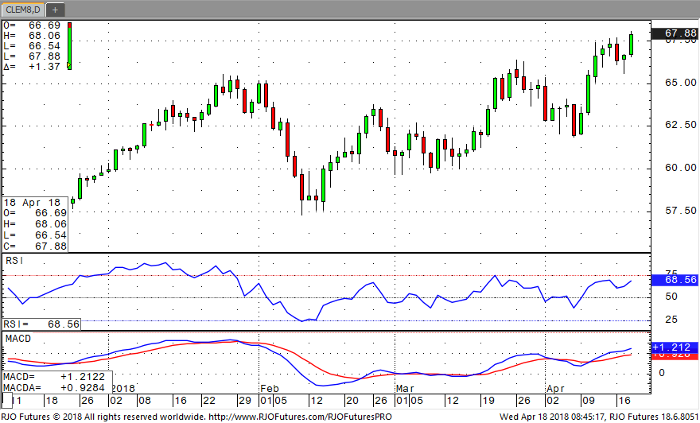

Crude Oil Jun ’18 Daily Chart