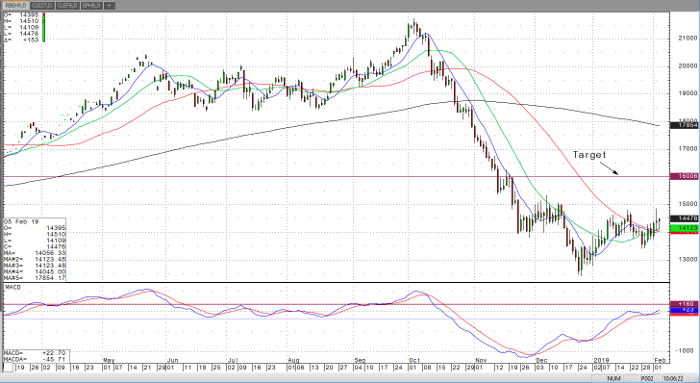

The energy sector products look to be setting up a breakout to the upside. In particular, I really like the set up in crude oil and RBOB gasoline futures. In my opinion, the daily charts are coiling and will have a sharp rally once there is a close above $55.50 in March crude and $1.4800 in March RBOB gasoline. Both products have come down sharply from October 2018 highs and my target objectives are relatively modest. I’m expecting crude futures to reach the $60.00 range and RBOB gasoline can easily retrace back to $1.6000 and quite possibly closer to $1.7500. RBOB Gasoline also have very strong seasonal tendencies in February.

I think that crude and RBOB have based bottoms. Markets cannot stay sideways forever, especially markets with the type of volatility found in the energies. It’s easy to look at the charts and say that “there is more upside potential, than downside at these levels,” but traders much manage downside risk accordingly.

If you would like to learn more about energy futures, please check out our free Fundamentals of Energy Futures Guide.

Rbob Gasoline Mar ’19 Daily Chart