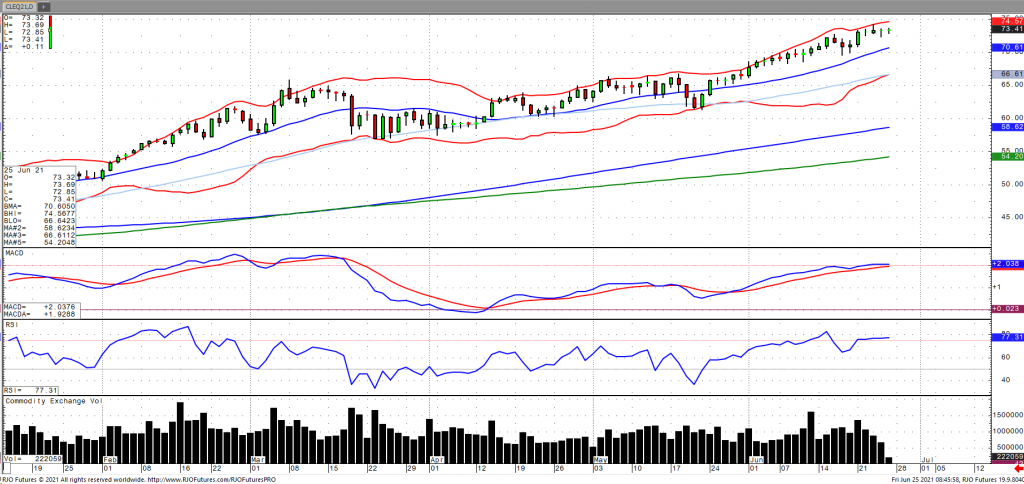

Oil prices have come off their Wednesday lows as the global recovery demand continues to come into focus amidst higher highs in European high frequency data following an improvement in German business confidence and Eurozone manufacturing as well as services PMI earlier this week. This was coupled with a drawdown in oil inventories as US crude inventories fell to their lowest since March 2020 with US gasoline stocks posting a surprise draw as well, according to the EIA. OPEC+ are set to meet on July 1st to discuss output cuts and a potential increase in production. This comes as doubts remain regarding Iranian oil coming back online despite claims of an impending end to Iranian sanctions. The market remains bullish trend with today’s range seen between 70.22 – 74.13.