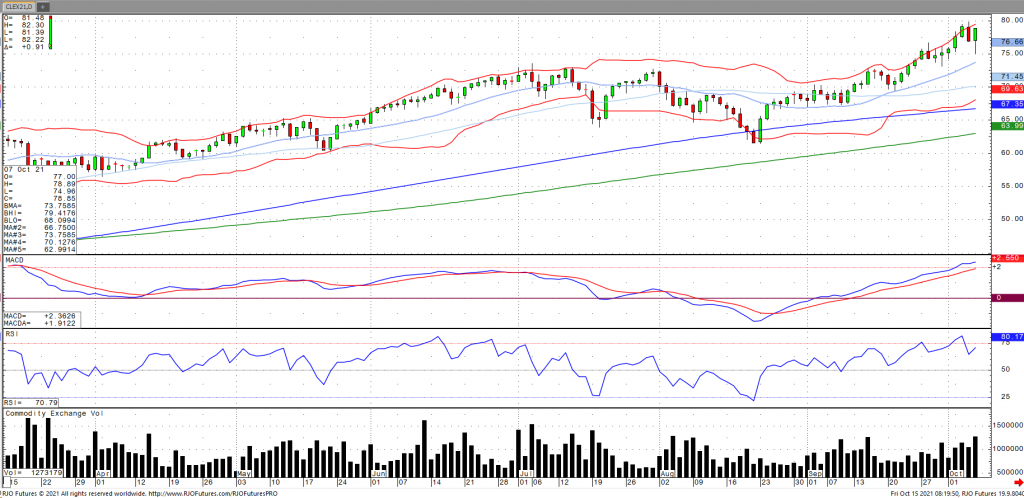

Oil prices continued to inflate higher as of Friday morning and are set to for a weekly gain of more than 2% on increasing signs of tightening supply. This comes as OPEC+ dismissed the notion of additional supply coming online coupled with the IEA noting that increasingly higher gas prices could boost oil demand with their expectation that oil demand is set to jump half million barrels per day (bpd), which would result in a supply crunch of around 700k bpd through the end of the year. The IEA noted in its monthly report that oil demand is forecasted to increase by 210,00 bpd in 2022 and oil demand to reach 99.6 million bpd. This comes as weekly US crude stocks rose by 6.088mb, much greater than the expected 702k barrels. Contributing to the build was a slowdown in refinery utilization (-2.9%) and refinery input (-684bpd). Oil volatility (OVX) continues to breakdown to cycle lows with the market remaining bullish trend with today’s range seen between 76.29 – 83.24.