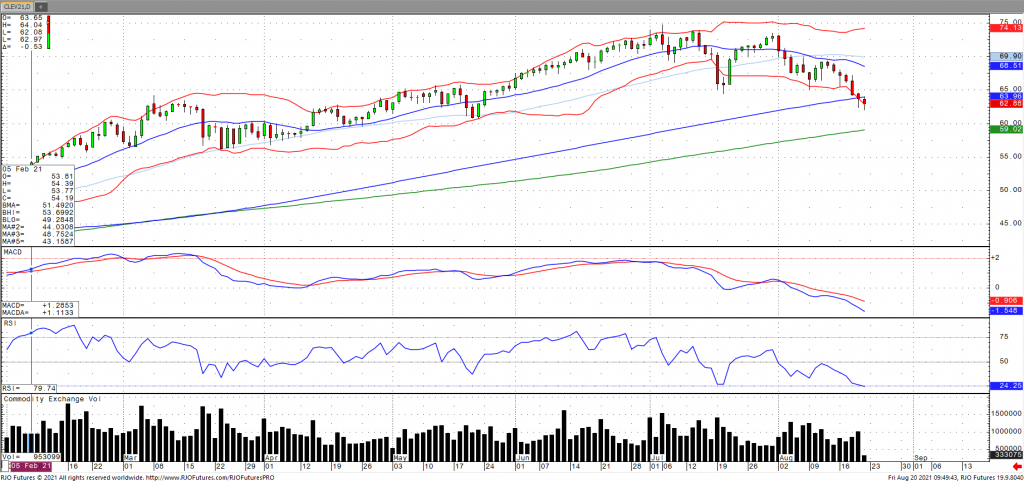

Oil prices are down for the seventh consecutive session on Friday, hovering on three-month lows as the increased cases of the delta variant continue to dampen the global demand outlook. The growing expectation of a reduction asset purchases by the US Federal Reserve has caused the jump in the US Dollar amid this broad risk off sentiment. EIA inventory data was in fact supportive with stocks falling 3.233 million barrels putting supply at the lowest level since January 2020. The US refinery rate came in at 92.2% which should continue to prop up demand for US supplies. Also discounted have been reports that OPEC+ compliance in terms of production came in at 109% for the month of July. Despite down over 6% on the week, oil continues to hold onto bullish trend with today’s range seen between 62.23 – 69.19.