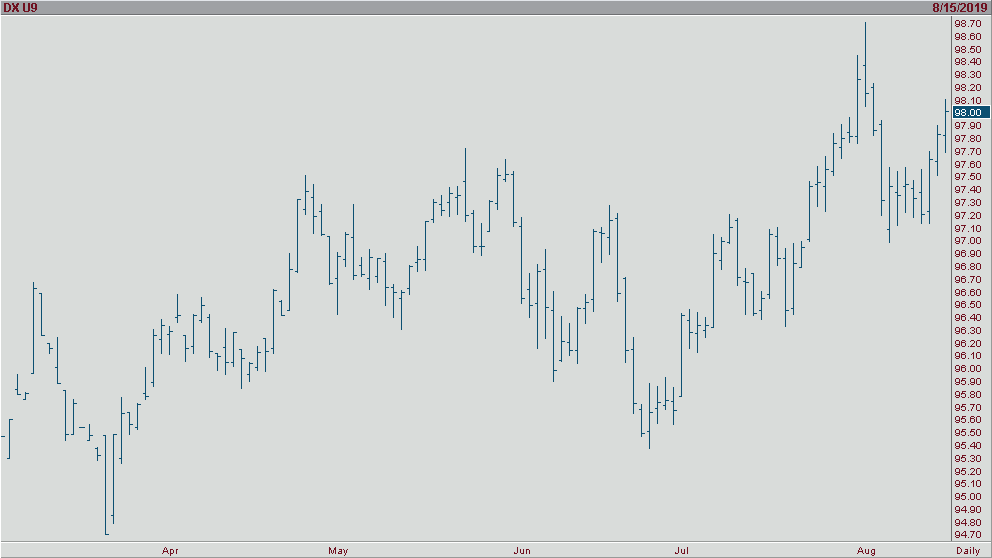

The USD has gained in light of recent economic uncertainties following a more than 700pt decline in the Dow Jones futures. Probably the newsiest event of the week was the inversion of the 2-yr and 10-yr yield spread. Often times the inversion of the yield curve is a harbinger for an oncoming recession and casts doubt over the safety of foreign currencies vs the U.S. Dollar. On top of the bond yield inversion, we’ve also heard news of the ECB preparing to launch a “major” stimulus program at its next meeting in September. The news of such events is very bearish for the euro, which is being reflected in its recent 150 point decline over this past week. We do expect the U.S. dollar to eventually struggle as it continues to grind towards its Aug 1st highs of 98.93 in the cash market. The strength of the USD has threatened US Manufacturing (presently at recession levels), but has kept the U.S. consumer in a good place despite trade war with China. Until then, the dollar continues to be the currency world’s favorite safe haven choice.