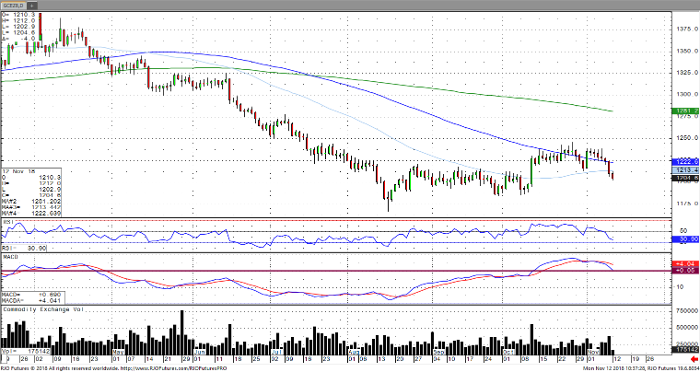

Renewed strength in the U.S. dollar has continued to extend the downside move in the precious metal with the dollar trading at a 16-month high. Producer Price Index came in higher than expected on Friday with the largest increase in six years, which only provided further support for the U.S. dollar. This comes amid the release of the FOMC minutes which reaffirmed the Fed’s stance on tightening along with their odds of a rate hike in December. In a longer term outlook, gold ETF’s increased their holdings by $1 billion in October. While the precious metal is likely to remain under pressure through the December rate hike window, the market is near oversold levels and may catch a bid as an inflationary hedge. The next downside target can be observed around 1195 with the possibly of a retest of the September consolidation lows. Near term resistance comes in around 1215.

Gold Dec ’18 Daily Chart