Goldman Sachs put out a note yesterday suggesting “de risking” of portfolios was nowhere to be seen over the recent 10% slide in the Nasdaq and SP500. As a matter of fact, the crowd doubled down and got even LONGER of US Equities. Whether this is right or wrong, remains to be seen, but what’s clear to me is that “something” has changed. The 15% wipe out in crude oil (which we’re long of and is clearly a mistake) is in ominous signal for inflation/deflation. What I’d pay very close attention too here is copper prices as well – typically a leading indicator for a healthy vs unhealthy global economy. At the moment, Copper remains steadfast north of 3.00 lb.

Global Equities

USA- Volatile session overnight, SP500 -0.17%, NASDAQ +0.43%, Russell 2000 -0.11%

Europe- GER +0.10%, UK -0.25%, FRA -0.10%, SPA -0.25%

Asia- Shanghai -0.61%, KOSPI +0.81%

Top News and Data

*The ECB left policy unchanged this morning, holding rates at 0.00% and continuing there Pandemic Emergency Purchase Program (PEPP) steady at 1.35B Euro/month. Christine Lagarde’s press conference will begin momentarily for more color on the meeting.

*Jobless Claims 884K vs 881K previous

*PPI (USA) 0.6% vs 0.3% Y/Y

Commodities

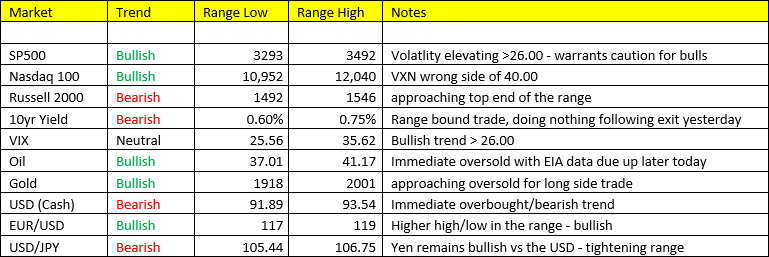

Metals: Gold up 0.54% to 1965.00 after the ECB meeting as the USD devalues to 92.86 -0.41%. We think gold has a chance in coming weeks to regain its bullish fervor and make another dash north of 2000oz in our assessment. Silver is also regaining its bullish momentum +1.69%. We remain bullish of metals since we made the call at the end of 2018.

Energy: Natural Gas is approaching our “Buy Zone”. Nat Gas -14% over the past 2 weeks, following its 92% !! multi week rally since June. Our traders may be receiving a “Buy Signal” in nat gas today.

*Crude Oil, we’re staying with the bullish call for now as oil is immediate oversold and still (albeit by a slim margin) holding its bullish trend.

Treasuries: Yields are bouncing on the PPI data (which came in hotter than expected), and will likely see more heated inflation data tomorrow with the CPI (Consumer) Index. We have no immediate recommendation on in Treasuries (we do still have it on our Core Long Positions List – we have so since Q4 2018) Undoubtedly this “Call” is becoming stale, but we’ll stay with it.