“Probability is not about the odds, but about the belief in the existence of an alternative, outcome, cause, or motive”. – Nassim Teleb

That’s from Teleb’s book “Fooled by Randomness”. Teleb also authored “The Black Swan” and “Skin in the Game”. The model we track is now suggesting a 39% chance of a return to Scenario 4 in Q4 2020. That’s not meant to scare you, but to acknowledge that there is a rising probability of an alternative outcome from what the “heard” expects. Probabilities do not equal exactness, or a definitive outcome, nor do I have the ability to predict the future, that type of thinking would fall under the category of foolish. But we do deal in probabilities based on reported data, and we’re beginning to see diverging signals between the relationship of high levels of sustained unemployment, and commerce sentiment. All the while corporate credit, and household credit, and disposable income continue to trend lower. Regardless, much of what we’re positioned for already should continue to work regardless of a Scenario 3 or Scenario 4 outcome. Precious Metals, and Treasuries.

Global Equities:

USA: SP500 +1.24%

Europe: Flat to higher across the region

Asia: Shanghai +0.57%, KOSPI +1.30%

Let’s review last week:

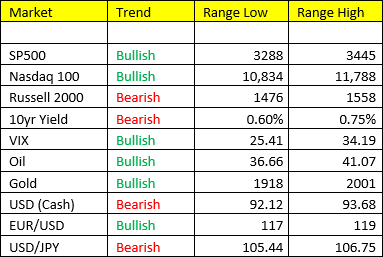

*The USD had its 2nd “up” week in a row (which hasn’t occurred since early June), finishing its 2 week bounce to +1.6%. We remain bearish of the USD.

*The GBP lost -3.3% (the biggest loser in the currency space) as BREXIT news returned to front page headlines.

*VIX is crossed and closed above our bull/bear trend line of 26.00, climbing to 38.00 over the past week and a half, but beginning to flatten out again this morning.

*Gold finished the week modestly lower, and doesn’t necessarily look exceedingly strong at the moment. We’re conscious of the possibility of another “dip” in Gold and Silver prices. Although I must say that I’m impressed with how the precious metals have been able to weather storm in equities and “strengthening” dollar. All eyes will be on Jerome Powell and the Fed this week.

*Energy: Nat Gas lost big last week, -12.7% – I’m intrigued to send out a buy signal here for a trade

Crude Oil shed -5.6% – same thing, I may (or may not) come back in here for near-term long side trade. BUT, with the rising probability of another Growth/Inflation slowing scare in Q4 – it might be prudent to just wait and let time and space dictate what we do next.

Gotta leave it there this morning, I’ll be in touch throughout the day. Good luck.